Pourquoi la FED n'a pas baissé ses taux

Je viens de lire un excellent résumé de la situation macro-économique sur i-tulip.com.

Il argumente brillament pourquoi l'issue la plus probable est l'inflation plutôt que la déflation.

Je le reproduis ici en partie.

En résumé : il ne faut pas commettre l'erreur de penser que les Etats-Unis aujourd'hui sont dans une situation similaire à celle des années 30 ou à la situation du Japon dans les années 90. Durant ces périodes le pays était "créditeur net".

Aujourd'hui la situation est plutôt similaire à celle de la Russie en 1998, de l'Argentine en 2001-2002 et également de l'Allemagne dans les années 30.

Tous ces pays sont "débiteurs net".

Evidemment la différence d'importance entre ces pays et les Etats-Unis aujourd'hui est que le dollar est encore considéré comme une monnaie de réserve et une valeur refuge, mais cela peut changer, car il s'agit juste d'une perception et non d'un fait.

Voici l'article avec les graphiques :

--------------

Why the Fed can’t lower rates

Wondering why the Lehman failure and yesterday’s 500 point DOW drop didn’t move the Fed? Short term, a cut won’t help. Long term, cuts shrink an already very short runway to zero bound hell.

The effective Fed Funds rate shot up from 2.1% on Friday to 6% yesterday against a Fed Funds target rate of 2%. That’s because the Lehman bankruptcy left lenders to Lehman on the hook for hundreds of billions in losses. Now banks are afraid to lend to each other. We haven’t see that kind of dis-function since the crash of 1987.

The Fed is thinking, Why use up ammo when the bond markets can’t do anything with it anyway?

More importantly, we explained to subscribers in Zero Bound Diaries: Is Bernanke Volcker's Mirror Image? Feb. 12, 2008 ($ubscription), that the Fed is going to stop targeting rates and start to target aggregates after they drop rates to 2%, as it turned out two months later in April 2008. We can’t see the rise in M3 because the government doesn’t report M3 anymore -- clever.

The reason they are targeting aggregates is that as deflationary forces intensify with debt defaults, tightening lending standards, and a shrinking pool of credit-worthy borrowers, rate targeting (the price of money) becomes less effective as a policy tool to manage inflation. Targeting money aggregates (the quantity of money) becomes a more effective tool.

It’s the flip side of the problem that the Fed had in the late 1970s when inflation was very high. The Fed switched to targeting quantity over price then, between 1979 to 1982, because money price targeting is ineffective at the extremes of high and low inflation.

Instead of cutting rates, the Fed pumped in more cash.

Not like this:

Net creditor at the zero bound: Japan 1990 - 2005

Currency strengthens, capital flows in, deflation dynamics set in

...or this:

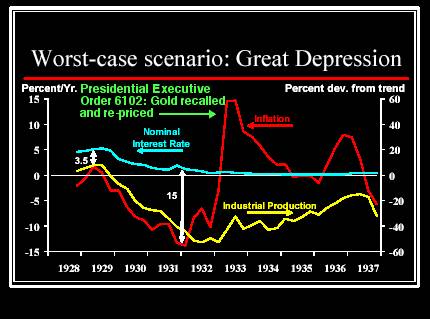

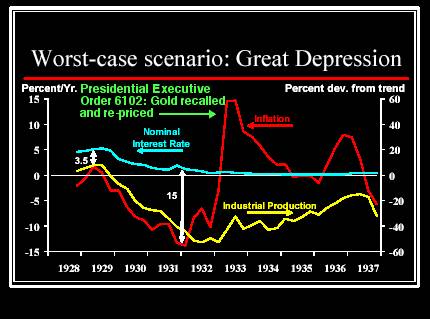

Net creditor at the zero bound: US 1927 - 1937

Currency strengthens, capital flows in, deflation dynamics set in

Net creditors like the US in the 1930s and Japan in the 1990s became recipients of global flight capital in a global financial and economic crisis; the currencies of net creditors appreciate relative to their trade partners’ as a result. As a percentage of GNP, the US is now a major net debtor. It is therefor vulnerable to the effects of a reversal in capital flows.

Like this:

Net debtor at the zero bound: Argentina 1995 - 2008

Currency weakens, capital flees, inflation spikes

...and this:

Net debtor at the zero bound: Russia 1995 - 2000

Currency weakens, capital flees, inflation spikes

The US has many advantages over both of these net debtor cases:

Expectations drive markets short term, reality drives them long term

Wait a minute, you say. Isn’t the dollar shooting up as money pours back into the US from emerging markets? Don’t forget the old adage, there’s nothing harder than emerging money from an emerging market during an emergency. Right?

The US recovered from 2004 and 2006 because of growth driven by the housing bubble and foreign lending. Did you know 70% of the US fiscal – not trade – deficit was financed by foreign lending in 2003? True fact. What does a government do if it can't borrow the money? Three options: cut spending, thereby increasing unemployment, raise taxes, thereby cutitng demand, or print money, thereby wrecking the purchasing power of money – including tax revenues. That's how hyperinflations happen – the more the government prints to pay fixed expenses the more it has to print to pay fixed expenses.

The US has been a safe haven for capital for decades. That changed with the terminal demise of the FIRE Economy starting in early 2007, but the global habit of thinking of the US the other way, as if it still were a safe haven, has not.

Don’t be fooled by this bounce in the dollar. As soon as market participants realize that it cannot be sustained, it's curtains for 35 years of the borrow-and-spend FIRE Economy.

Different this time for the US, same old same old for all net debtors in trouble throughout history

In this global contraction, will Japan, China, Russia, Brazil et al be able to continue to finance America’s twin fiscal and trade deficits? Not if they are in recession, too, because – and this is key – demand from the US for their exports are falling off a cliff because the housing bubble demand engine died, an engine that directly via credit expansion and indirectly via purchases of consumer goods to fill houses, justified the foreign lending in the first place.

Now unemployment is rising, credit and incomes are shrinking, and the future driver for the US economy in the wings that I am promoting – investment in transportation, energy, and communications infrastructure – has not yet gotten off the ground.

The US is now like any other net debtor in an economic crisis without a way to grow its way out of debt.

This time the US is in a position similar to Germany in 1930, Russia in the early 1990s or Argentina in the early 2000s, dependent on borrowing from countries that lost their ability to lend due to their own problems. Such countries become victims of global capital flight in a worldwide financial and economic crisis when a falling global economic tide lowers all ships.

I know it’s hard to get your head around as an American because you love your country but it’s time for you to start to think of the US as at risk of capital flight versus a safe haven.

How much faith do you have in the Fed?

As we mentioned in Future inflation fears topple TIPS, by reducing exposure to inflation-index bonds the US government is not preparing for deflation.

A once-in-a-century crash may occur if the Fed botches this and we get too close to the zero bound before the economy grows again. At this point in the race between the disinflationary impact of recession and debt deflation and the inflationary impact of moving all manner of worthless assets onto the Fed’s and Federal Government’s balance sheets, disinflation may be winning. At some point before the zero bound is reached, never mind the point of actual deflation (negative inflation rate such as -2%), if the US experience is like any other net debtor's in history a currency accident will occur as global financial markets realize that the US position as a safe haven relative to its trade partners has reversed. A rapid, self-reinforcing process of capital flight and dollar depreciation that we call “Poom” will begin.

The Fed knows this. It is doing everything it can to keep inflation above zero and maintain dry powder, and that means keeping the Fed Funds rate target over 2%.

Fed Funds effective rate spikes to 6% from 2.1% versus target rate of 2%

the day of the Lehman bankruptcy

Il argumente brillament pourquoi l'issue la plus probable est l'inflation plutôt que la déflation.

Je le reproduis ici en partie.

En résumé : il ne faut pas commettre l'erreur de penser que les Etats-Unis aujourd'hui sont dans une situation similaire à celle des années 30 ou à la situation du Japon dans les années 90. Durant ces périodes le pays était "créditeur net".

Aujourd'hui la situation est plutôt similaire à celle de la Russie en 1998, de l'Argentine en 2001-2002 et également de l'Allemagne dans les années 30.

Tous ces pays sont "débiteurs net".

Evidemment la différence d'importance entre ces pays et les Etats-Unis aujourd'hui est que le dollar est encore considéré comme une monnaie de réserve et une valeur refuge, mais cela peut changer, car il s'agit juste d'une perception et non d'un fait.

Voici l'article avec les graphiques :

--------------

Why the Fed can’t lower rates

Wondering why the Lehman failure and yesterday’s 500 point DOW drop didn’t move the Fed? Short term, a cut won’t help. Long term, cuts shrink an already very short runway to zero bound hell.

The effective Fed Funds rate shot up from 2.1% on Friday to 6% yesterday against a Fed Funds target rate of 2%. That’s because the Lehman bankruptcy left lenders to Lehman on the hook for hundreds of billions in losses. Now banks are afraid to lend to each other. We haven’t see that kind of dis-function since the crash of 1987.

The Fed is thinking, Why use up ammo when the bond markets can’t do anything with it anyway?

More importantly, we explained to subscribers in Zero Bound Diaries: Is Bernanke Volcker's Mirror Image? Feb. 12, 2008 ($ubscription), that the Fed is going to stop targeting rates and start to target aggregates after they drop rates to 2%, as it turned out two months later in April 2008. We can’t see the rise in M3 because the government doesn’t report M3 anymore -- clever.

The reason they are targeting aggregates is that as deflationary forces intensify with debt defaults, tightening lending standards, and a shrinking pool of credit-worthy borrowers, rate targeting (the price of money) becomes less effective as a policy tool to manage inflation. Targeting money aggregates (the quantity of money) becomes a more effective tool.

It’s the flip side of the problem that the Fed had in the late 1970s when inflation was very high. The Fed switched to targeting quantity over price then, between 1979 to 1982, because money price targeting is ineffective at the extremes of high and low inflation.

Instead of cutting rates, the Fed pumped in more cash.

Fed pumps $70 billion into financial system to ease stresses as markets tumbleThe name of the game is to maintain the money supply as needed to keep inflation above zero percent because for a net debtor very ugly things happen at the zero bound.

Sept. 16, 2008 (AP)

Urgently trying to keep cash flowing amid a Wall Street meltdown, the Federal Reserve on Tuesday pumped another $70 billion into the nation's financial system to help ease credit stresses.The Federal Reserve Bank of New York's action came in two operations in which $50 billion and then another regularly scheduled $20 billion were injected in temporary reserves

Not like this:

Net creditor at the zero bound: Japan 1990 - 2005

Currency strengthens, capital flows in, deflation dynamics set in

...or this:

Net creditor at the zero bound: US 1927 - 1937

Currency strengthens, capital flows in, deflation dynamics set in

Like this:

Net debtor at the zero bound: Argentina 1995 - 2008

Currency weakens, capital flees, inflation spikes

Net debtor at the zero bound: Russia 1995 - 2000

Currency weakens, capital flees, inflation spikes

The US has many advantages over both of these net debtor cases:

- US foreign debt is denominated in US currency so it does not need to sell dollars to repay debt in another currency

- Most of the debt is long term so it does not need to be rolled over

- Foreign governments not private institutions now hold the majority of US debt so the foreign trade in US debt is less volatile but on the other hand more political

- The US has a long history of political stability and come-backs from economic crisis so investors tend to believe that the US will quickly recover it s economic footing

Expectations drive markets short term, reality drives them long term

Wait a minute, you say. Isn’t the dollar shooting up as money pours back into the US from emerging markets? Don’t forget the old adage, there’s nothing harder than emerging money from an emerging market during an emergency. Right?

The US recovered from 2004 and 2006 because of growth driven by the housing bubble and foreign lending. Did you know 70% of the US fiscal – not trade – deficit was financed by foreign lending in 2003? True fact. What does a government do if it can't borrow the money? Three options: cut spending, thereby increasing unemployment, raise taxes, thereby cutitng demand, or print money, thereby wrecking the purchasing power of money – including tax revenues. That's how hyperinflations happen – the more the government prints to pay fixed expenses the more it has to print to pay fixed expenses.

The US has been a safe haven for capital for decades. That changed with the terminal demise of the FIRE Economy starting in early 2007, but the global habit of thinking of the US the other way, as if it still were a safe haven, has not.

Don’t be fooled by this bounce in the dollar. As soon as market participants realize that it cannot be sustained, it's curtains for 35 years of the borrow-and-spend FIRE Economy.

Different this time for the US, same old same old for all net debtors in trouble throughout history

In this global contraction, will Japan, China, Russia, Brazil et al be able to continue to finance America’s twin fiscal and trade deficits? Not if they are in recession, too, because – and this is key – demand from the US for their exports are falling off a cliff because the housing bubble demand engine died, an engine that directly via credit expansion and indirectly via purchases of consumer goods to fill houses, justified the foreign lending in the first place.

Now unemployment is rising, credit and incomes are shrinking, and the future driver for the US economy in the wings that I am promoting – investment in transportation, energy, and communications infrastructure – has not yet gotten off the ground.

The US is now like any other net debtor in an economic crisis without a way to grow its way out of debt.

This time the US is in a position similar to Germany in 1930, Russia in the early 1990s or Argentina in the early 2000s, dependent on borrowing from countries that lost their ability to lend due to their own problems. Such countries become victims of global capital flight in a worldwide financial and economic crisis when a falling global economic tide lowers all ships.

I know it’s hard to get your head around as an American because you love your country but it’s time for you to start to think of the US as at risk of capital flight versus a safe haven.

How much faith do you have in the Fed?

As we mentioned in Future inflation fears topple TIPS, by reducing exposure to inflation-index bonds the US government is not preparing for deflation.

A once-in-a-century crash may occur if the Fed botches this and we get too close to the zero bound before the economy grows again. At this point in the race between the disinflationary impact of recession and debt deflation and the inflationary impact of moving all manner of worthless assets onto the Fed’s and Federal Government’s balance sheets, disinflation may be winning. At some point before the zero bound is reached, never mind the point of actual deflation (negative inflation rate such as -2%), if the US experience is like any other net debtor's in history a currency accident will occur as global financial markets realize that the US position as a safe haven relative to its trade partners has reversed. A rapid, self-reinforcing process of capital flight and dollar depreciation that we call “Poom” will begin.

The Fed knows this. It is doing everything it can to keep inflation above zero and maintain dry powder, and that means keeping the Fed Funds rate target over 2%.

Fed Funds effective rate spikes to 6% from 2.1% versus target rate of 2%

the day of the Lehman bankruptcy

Commentaires