Les particuliers affluent sur les marchés actions...

Cela peut paraitre paradoxal étant donné le marasme économique, mais il semble que de nombreux particuliers ont ouvert des comptes de courtage en ligne ces derniers temps et ils sont haussiers pour la majorité

D"un point de vue contrarien, on peut dire avec confiance, que cela n'augure rien de bon pour l'évolution future des marchés actions.

Les particuliers en moyenne prennent de mauvaises décisions , surtout pour du trading à court-terme...

Par ailleurs , il faut rappeler que le marché n'a jamais été aussi "cher" d'après les données historiques...

Source : Zerohedge

Lisez cet article

-----------------

MoMo chasing newbie traders are about to get their clocks cleaned as they will soon realize that the rally in stocks is nothing more than a corrective wave in a bear market.

D"un point de vue contrarien, on peut dire avec confiance, que cela n'augure rien de bon pour l'évolution future des marchés actions.

Les particuliers en moyenne prennent de mauvaises décisions , surtout pour du trading à court-terme...

Par ailleurs , il faut rappeler que le marché n'a jamais été aussi "cher" d'après les données historiques...

Source : Zerohedge

Lisez cet article

-----------------

"Poor Decisions" Galore As Newbie Millennial/Gen-X-ers Pour Into Expensive Stock Market

Online brokerages are reporting a massive increase in new accounts and trading activity among newbie retail clients during this year's stock market turmoil triggered by coronavirus lockdowns, reported The Wall Street Journal.

Pajama traders have been enticed by zero commission trades offered by TD Ameritrade Holding and E*Trade Financial Corp.

Many of these first-time traders are "BTFD" as they believe a V-shaped recovery in the stock market and economy are inevitable. After all, it happened in 2016, 2019, why not in 2020?

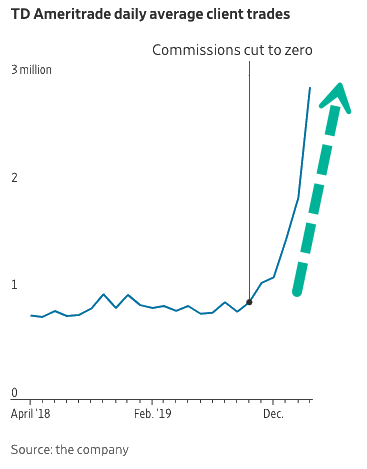

Shown below, TD Ameritrade's daily average client trades soared when commissions slashed to zero in 4Q19 and continue to rise through the pandemic.

The Journal interviewed several retail traders, putting their life savings into a brokerage account because they believe with zero commission trades, now is the time to be invested.

Eugene LeGrand,34, a construction estimator, said he was super excited about free trades and set up a TD Ameritrade account in January, putting his money into gun stocks as he thought they would erupt during the election year. LeGrand said as the market dipped, he panic bought "shares of oil giants, airlines and car-rental businesses—all," all because he believed a massive economic rebound is ahead.

LeGrand turned to Facebook groups for investing ideas. He says his account has around $15,000 in it. However, we wonder, since he was buying gun stocks before the stock crash, how much did he initially put in his account?

"I feel like everything that I buy, I watch pretty closely and if it's something that's not doing well, I'll generally try to put [that money] into something that is doing well instead," he said. Working from home, he added, has allowed him to watch for those movements more easily.

TD Ameritrade added 608,000 accounts in the first quarter, Charles Schwab Corp. added 609,000 accounts, and E*Trade saw a gain of about 363,000.

Steve Quirk, executive vice president of trading and education at TD Ameritrade, said the number of new clients has increased since zero commission trades started late last year. He noted recent account increases had been seen mainly with "millennials and Generation X."

In past selloffs, brokerages have noted that accounts and volumes of trades tend to tick higher as retail clients look for opportunities.

"People are absolutely more engaged here because you've removed the cost to trade," said Devin Ryan, an analyst at JMP Securities.

We noted in one study that at least 97% of Brazilian day traders lost money. Other studies have shown that swing trading usually end in sad stories among pajama traders.

"On average, when individual investors are actively buying and selling stocks, they tend to make poor decisions," said Terrance Odean, a finance professor at the University of California, Berkeley. Odean worries that free trades could encourage risky trading by novices.

Will Nelson,27, another newbie trader that uses the Robin Hood trading app, has been dabbling in his $100 account in buying bullish options on tech stocks. He said bullish options were easy money in the last several years, but when stocks dropped because of the coronavirus pandemic, trading got hard.

"You have to be able to handle extremes," he said

Nelson said he panic bought the dip when stocks crashed several months ago, his account is up more than 244%.

Thomas Peterffy, chairman of Interactive Brokers Group Inc., said virus lockdowns has led to an increase of newbie traders:

"Many people have been promising to themselves that one day they would learn about how to invest and manage their own finances," Peterffy said." Now that they must stay at home, they have the time to do that."

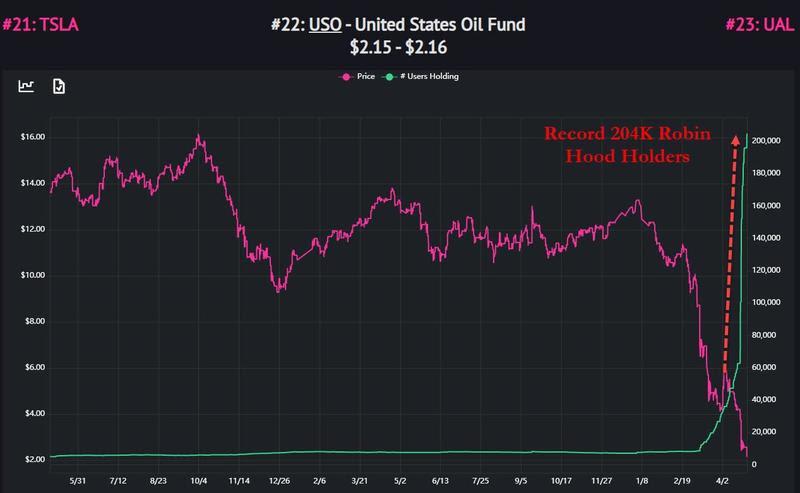

We noted several days ago how retail traders on the Robin Hood app, many of whom did not read the prospectus of USO, were piling into the crashing USO ETF.

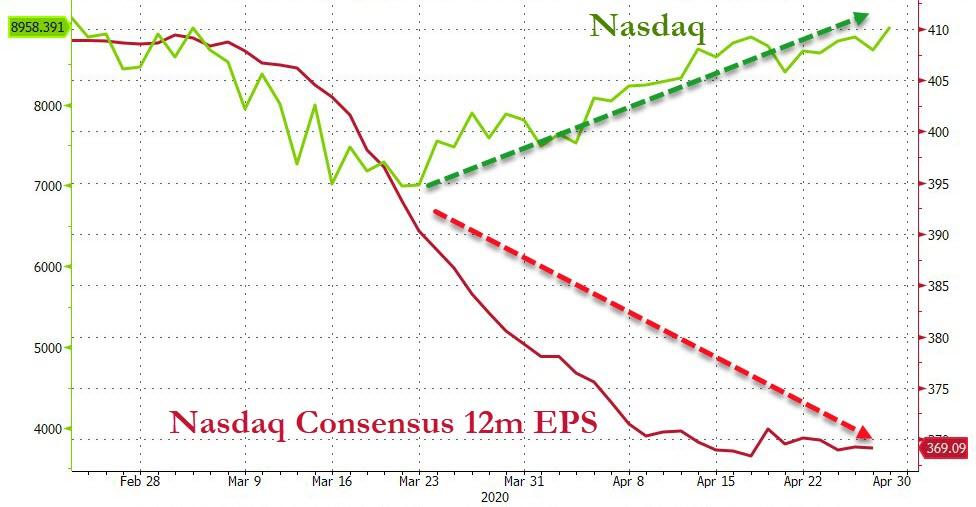

What newbie traders have trouble in understanding today is that the economy crashed, buying the dip because prices look cheap doesn't necessarily mean things are cheap -- that is an illusion. Price-earnings ratios for S&P500 and S&P500 Tech are back at nosebleed levels as earnings collapse.

The widening gap between Nasdaq and fundamentals suggests the collapse in earnings will make prices hard to justify in the near term and likely result in the unfolding of a bear market.

And finally, Warren Buffett's favorite indicator has soared to a new record high, signaling that stocks are the most expensive ever.