La FED a besoin d'un nouveau Krach pour pouvoir intervenir. Et elle a 992 Milliards de bonnes raisons de le faire...

992 Milliards de dollar. Il s'agit de la somme que le Trésor va devoir émettre dans les semaines qui viennent, de façon à financer les plans de protection de l'économie aux Etats-Unis, suite au COVID-19.

Car il s'avère que la politique de la FED n'est pas assez accommodante à court terme et que les montants du QE annoncé il y a deux mois ne sont pas suffisants...

Du coup, la courbe des taux est en train de s'aplatir, ce qui entraine une pénurie de dollar court terme et des effets indésirable pour la finance à la fois américaine et même mondiale.

Or comme Jerome Powell a exclu des taux d'intérêts négatifs et que le programme POMO (achat permanent de titres par la FED) est en train de se réduire, elle va devoir se lancer dans un nouveau programme de QE, mais aura besoin d'une nouvelle justification pour le faire,

Cette justification pourrait bien venir d'un nouveau krach qui pourrait être déclenché par ce dilemme qu'il reste à résoudre pour Powell...

Fascinant article de Zerohedge, tiré d'une analyse de Stuart Parks de Deusche Bank.

992 Billion Reasons Why The Fed Needs Another Market Crash In The Next Few Weeks Tyler Durden Wed, 05/13/2020 - 19:25

Speaking in a video conference organized by the Peterson Institute, turbo money printer Jerome Powell today reassured the market that negative rates are not something the Fed - which expanded its balance sheet by $2.6 trillion in the past two months - is contemplating now. Of course, that will change after the next market crash or if economic shutdowns return, but for now the Fed's message to traders was clear: don't push forward fed fund rates negative, which also catalyzed today's sharp market drop as a key source of potential forced easing was removed.

However, with Powell taking negative rates off the table (for now), it means the Fed has another problem on its hands, one which was first laid out by Deutsche Bank's credit strategist Stuart Sparks, who in a recent note said that "for all the measures taken by the Fed and fiscal authorities to counter the COVID19 shock, policy remains too tight." And, as Sparks adds, if the Fed opts to avoid negative policy rates - which appears to be the case - "further easing must be provided by the size and composition of the Fed’s balance sheet", meaning more QE.

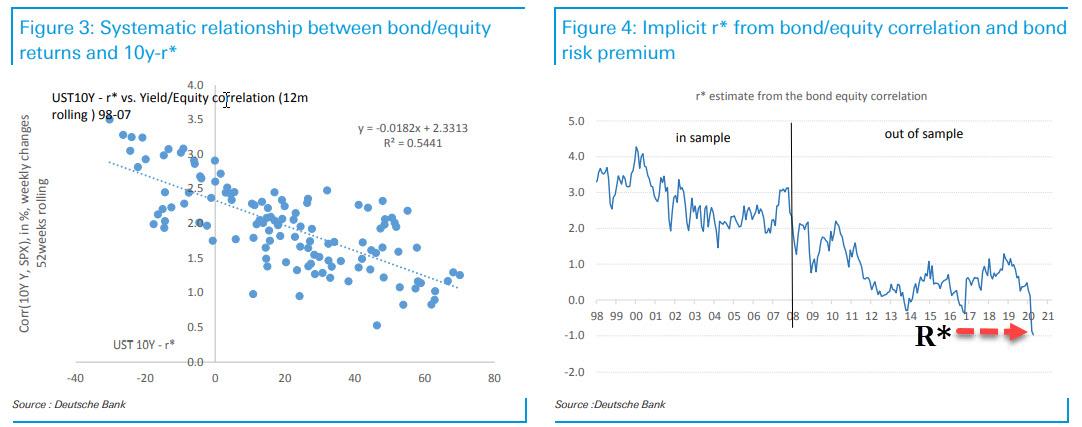

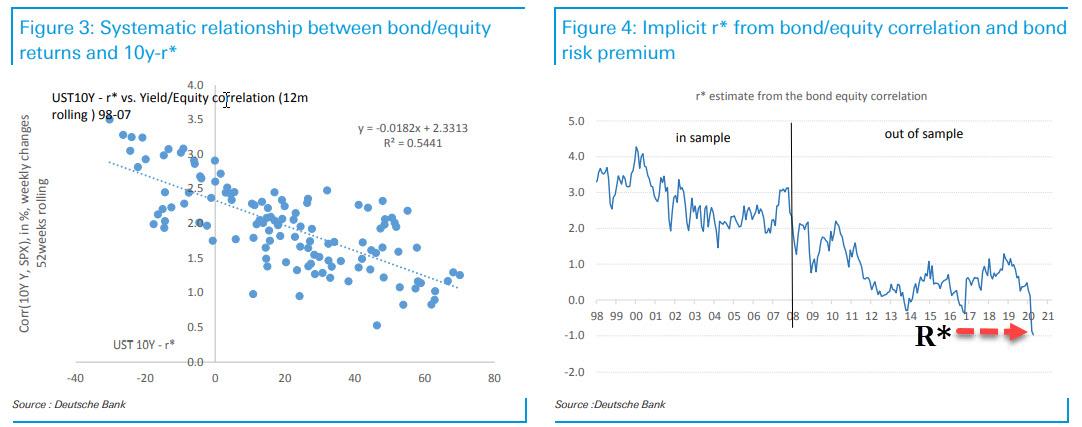

How much more QE? Well, with short-dated market real yields positive, Deutsche Bank estimates that r*, or the neutral rate of interest, has fallen to around -1%, "suggesting additional accommodation required for policy to be “easy” could be more than 100 bp in terms of “policy rate equivalent."

Previously the Fed had estimated that $100 billion in QE has approximately the same short term impact on growth as 3 bps of rate cuts. This equivalence means that in order to provide a 1% of “rate equivalent” easing, the Fed would need to grow the balance sheet by roughly $3.3 trillion.

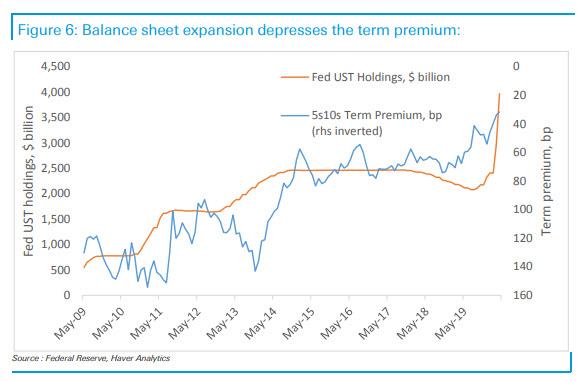

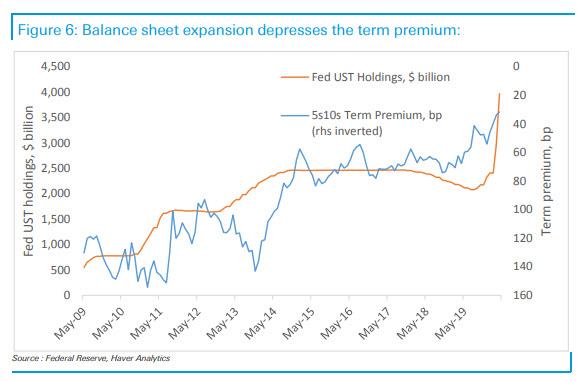

This creates a headache for the Fed in that balance sheet growth of this magnitude creates a structural supply/demand imbalance even given extraordinary Treasury funding needs, and should compress the term premium over time. And given Deutsche Bank projections for Treasury supply and Fed purchases, "this imbalance could be as large as $1.4 trillion. Ultimately, the argument is that the drain of duration supply dominates maturity selection implicit in Fed purchases, causing the term premium to decline." This is shown in the chart below.

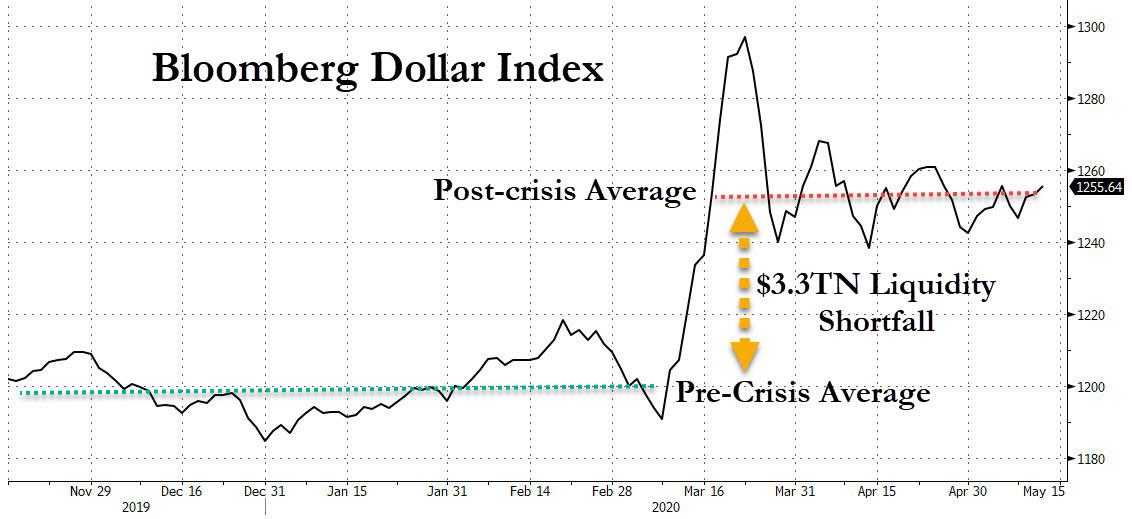

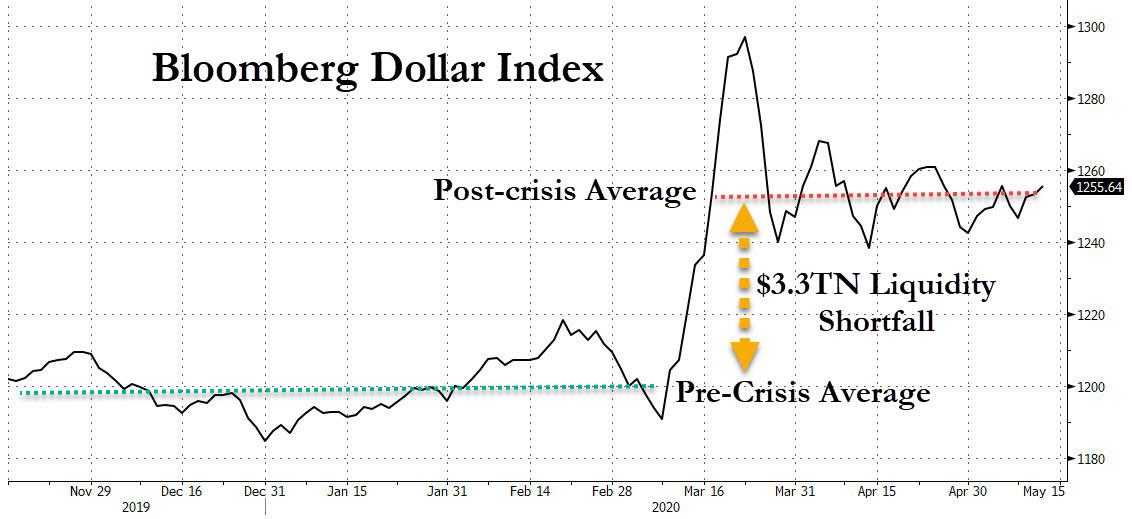

Even more term-premium distortions aside, the Fed has no choice as we explain below. Because, as crazy as it may sound, despite the Fed's massive liquidity injection to date which has pushed the Fed's balance sheet from $4.2 trillion to $6.7 trillion since mid-March, it is not enough and to ensure that the problem of the -1% r* is addressed without cutting rates negative - a problem which is now manifesting itself in a chronically high dollar, i.e., dollar shortage, which has failed to normalize back to pre-crisis levels as shown below...

... the Fed will need to expand its balance sheet trillions.... And it will have to do it very soon!

As Curvature Securities' strategist Scott Skyrm writes today, General Collateral unexpectedly dropped down to 0% yesterday and was below 0% today. And while this is "Strange", Skyrm correctly points out that "low GC rates can only be temporary."

The reason? There is a flood of liquidity-draining issuance on the horizon.

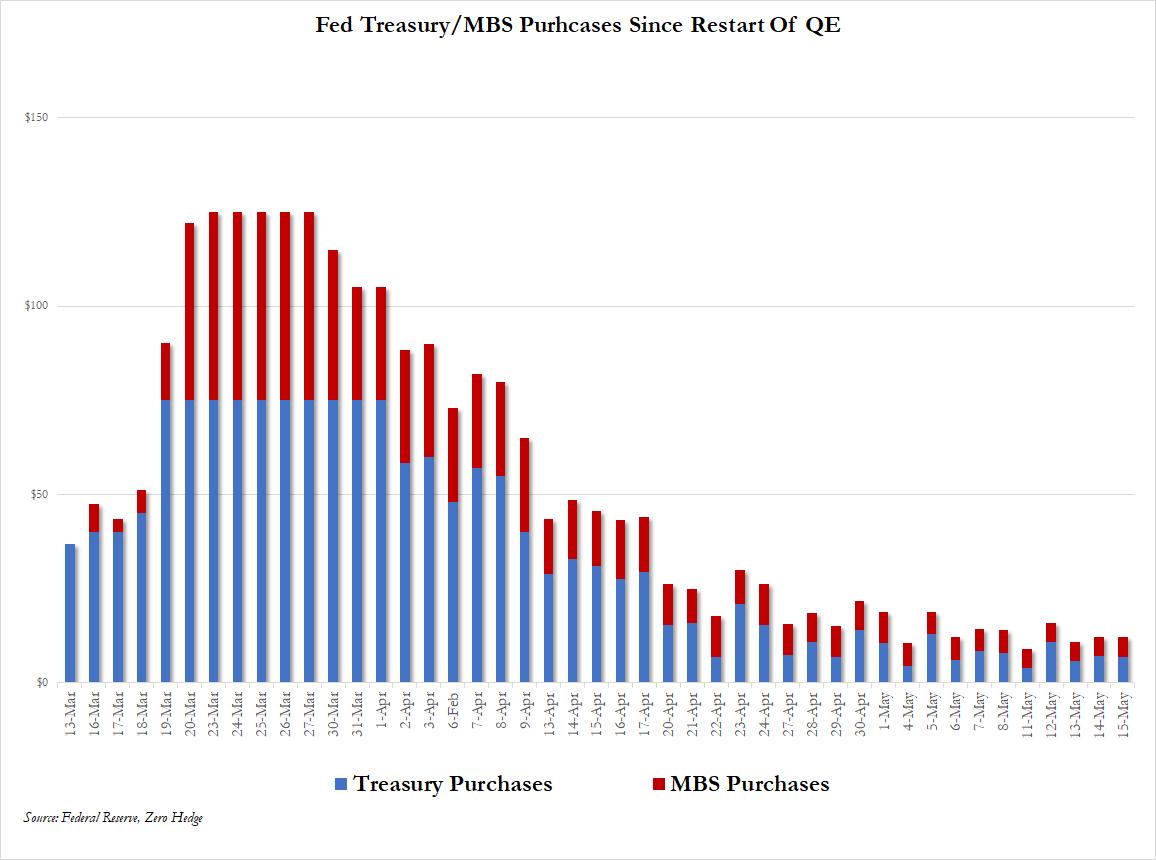

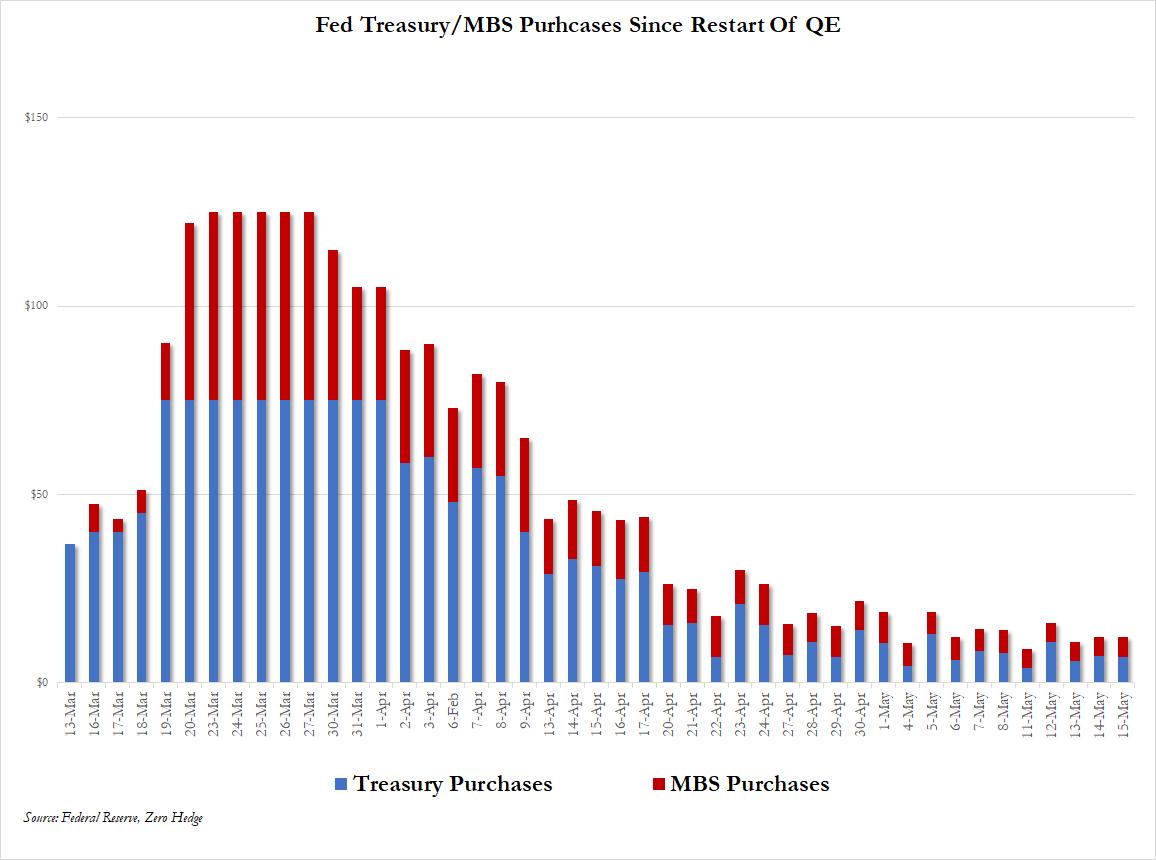

As Skyrm further explains, with QE purchases winding down - recall that last Friday the Fed cut its daily POMO average to just $7 billion from $75 billion two months ago...

... the deluge of more Treasury supply will ultimately push rates higher.

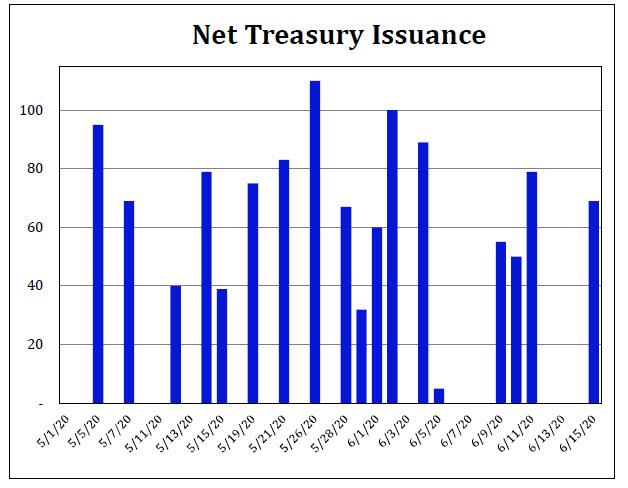

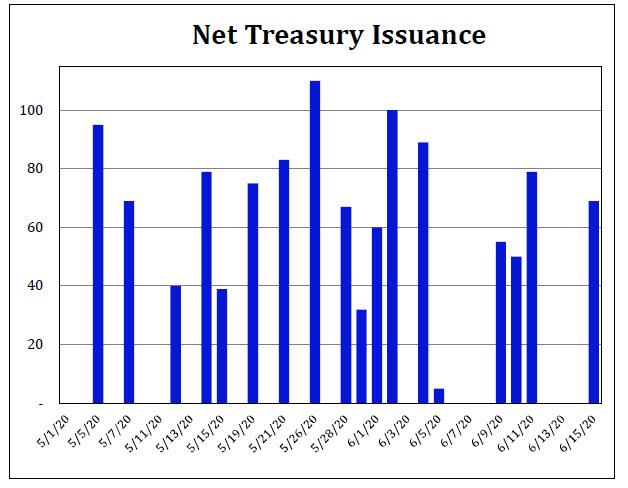

But in the near term, things are about to get scary: as Skyrm calculates, "there are $79 billion CMBs settling tomorrow and $39 net new Treasurys settling on Friday for the refunding. But that's just the start. All total, there are $689 billion net new Treasurys settling during the month of May and $992 billion net new Treasurys settling between now and June 15. Yes, almost one trillion new Treasury securities hitting the market within the next month!"

His conclusion: "That means the market needs to come up with about one trillion dollars to pay for those securities over the next month." Which, of course, is a euphemism because we all know who in the market needs to come up with one trillion dollar - the only one who literally prints money: the Federal Reserve.

For those who missed all that, here is the layman's version: the Fed has flooded the system with liquidity... and it is not enough, because the way helicopter money works, is that liquidity supply (the Fed), and liquidity demand (Treasury via debt issuance) go hand in hand, and periods of too much supply, as was the cash with the Fed's massive QE in late March and early April, are promptly followed by periods of dramatic liquidity demand, such as the next month when $1 trillion in liquidity will be drained to fund the US government "money helicopter."

This also suggests that Deutsche Bank's estimate of a $3.3 trillion cumulative shortfall is accurate and that the Fed will soon find itself trapped again, because instead of injecting liquidity it continues to drain it by shrinking the weekly POMO injection.

As a result, Powell faces a two-fold problem: since the Fed chair has taken negative rates off the table, Powell has no choice but too boost QE again, and unleash another firehose of liquidity in the financial system. However, any such reversal to the Fed's current posture of shrinking QE will be met with howls of rage, especially in the political establishment. Which means that, just like in March when the Fed used the first pandemic-induced market crash to unleash unlimited QE, the Fed will soon have to go for round 2 and spark a new market crash, one which it then uses as an alibi for the next massive liquidity injection. Failing to do that, watch as the dollar takes off as markets sniff out that another major dollar squeeze is imminent. And since this will accelerate the liquidity crunch, one way or another, the coming 992 billion net Treasury issuance will serve as a trigger for the next market shock, one which the Fed will quickly reverse by expanding the already unlimited QE by over $3 trillion on very short notice.

The only question we have is whether this will be the market crash that the Fed uses to unveil it will also buy equity ETfs next, or if Powell will save this final bullet in its ammo for whatever comes next.

Or comme Jerome Powell a exclu des taux d'intérêts négatifs et que le programme POMO (achat permanent de titres par la FED) est en train de se réduire, elle va devoir se lancer dans un nouveau programme de QE, mais aura besoin d'une nouvelle justification pour le faire,

Cette justification pourrait bien venir d'un nouveau krach qui pourrait être déclenché par ce dilemme qu'il reste à résoudre pour Powell...

Il se trouve que cette analyse cadre bien avec l'autre analyse qui venait de Nordea, et qui arrivait à un point de bascule à mi-Mai (20 Mai précisément), et que j'ai commenté sur ce post.

Fascinant article de Zerohedge, tiré d'une analyse de Stuart Parks de Deusche Bank.

------------------

992 Billion Reasons Why The Fed Needs Another Market Crash In The Next Few Weeks Tyler Durden Wed, 05/13/2020 - 19:25

Speaking in a video conference organized by the Peterson Institute, turbo money printer Jerome Powell today reassured the market that negative rates are not something the Fed - which expanded its balance sheet by $2.6 trillion in the past two months - is contemplating now. Of course, that will change after the next market crash or if economic shutdowns return, but for now the Fed's message to traders was clear: don't push forward fed fund rates negative, which also catalyzed today's sharp market drop as a key source of potential forced easing was removed.

However, with Powell taking negative rates off the table (for now), it means the Fed has another problem on its hands, one which was first laid out by Deutsche Bank's credit strategist Stuart Sparks, who in a recent note said that "for all the measures taken by the Fed and fiscal authorities to counter the COVID19 shock, policy remains too tight." And, as Sparks adds, if the Fed opts to avoid negative policy rates - which appears to be the case - "further easing must be provided by the size and composition of the Fed’s balance sheet", meaning more QE.

How much more QE? Well, with short-dated market real yields positive, Deutsche Bank estimates that r*, or the neutral rate of interest, has fallen to around -1%, "suggesting additional accommodation required for policy to be “easy” could be more than 100 bp in terms of “policy rate equivalent."

Previously the Fed had estimated that $100 billion in QE has approximately the same short term impact on growth as 3 bps of rate cuts. This equivalence means that in order to provide a 1% of “rate equivalent” easing, the Fed would need to grow the balance sheet by roughly $3.3 trillion.

This creates a headache for the Fed in that balance sheet growth of this magnitude creates a structural supply/demand imbalance even given extraordinary Treasury funding needs, and should compress the term premium over time. And given Deutsche Bank projections for Treasury supply and Fed purchases, "this imbalance could be as large as $1.4 trillion. Ultimately, the argument is that the drain of duration supply dominates maturity selection implicit in Fed purchases, causing the term premium to decline." This is shown in the chart below.

Even more term-premium distortions aside, the Fed has no choice as we explain below. Because, as crazy as it may sound, despite the Fed's massive liquidity injection to date which has pushed the Fed's balance sheet from $4.2 trillion to $6.7 trillion since mid-March, it is not enough and to ensure that the problem of the -1% r* is addressed without cutting rates negative - a problem which is now manifesting itself in a chronically high dollar, i.e., dollar shortage, which has failed to normalize back to pre-crisis levels as shown below...

... the Fed will need to expand its balance sheet trillions.... And it will have to do it very soon!

As Curvature Securities' strategist Scott Skyrm writes today, General Collateral unexpectedly dropped down to 0% yesterday and was below 0% today. And while this is "Strange", Skyrm correctly points out that "low GC rates can only be temporary."

The reason? There is a flood of liquidity-draining issuance on the horizon.

As Skyrm further explains, with QE purchases winding down - recall that last Friday the Fed cut its daily POMO average to just $7 billion from $75 billion two months ago...

... the deluge of more Treasury supply will ultimately push rates higher.

But in the near term, things are about to get scary: as Skyrm calculates, "there are $79 billion CMBs settling tomorrow and $39 net new Treasurys settling on Friday for the refunding. But that's just the start. All total, there are $689 billion net new Treasurys settling during the month of May and $992 billion net new Treasurys settling between now and June 15. Yes, almost one trillion new Treasury securities hitting the market within the next month!"

His conclusion: "That means the market needs to come up with about one trillion dollars to pay for those securities over the next month." Which, of course, is a euphemism because we all know who in the market needs to come up with one trillion dollar - the only one who literally prints money: the Federal Reserve.

For those who missed all that, here is the layman's version: the Fed has flooded the system with liquidity... and it is not enough, because the way helicopter money works, is that liquidity supply (the Fed), and liquidity demand (Treasury via debt issuance) go hand in hand, and periods of too much supply, as was the cash with the Fed's massive QE in late March and early April, are promptly followed by periods of dramatic liquidity demand, such as the next month when $1 trillion in liquidity will be drained to fund the US government "money helicopter."

This also suggests that Deutsche Bank's estimate of a $3.3 trillion cumulative shortfall is accurate and that the Fed will soon find itself trapped again, because instead of injecting liquidity it continues to drain it by shrinking the weekly POMO injection.

As a result, Powell faces a two-fold problem: since the Fed chair has taken negative rates off the table, Powell has no choice but too boost QE again, and unleash another firehose of liquidity in the financial system. However, any such reversal to the Fed's current posture of shrinking QE will be met with howls of rage, especially in the political establishment. Which means that, just like in March when the Fed used the first pandemic-induced market crash to unleash unlimited QE, the Fed will soon have to go for round 2 and spark a new market crash, one which it then uses as an alibi for the next massive liquidity injection. Failing to do that, watch as the dollar takes off as markets sniff out that another major dollar squeeze is imminent. And since this will accelerate the liquidity crunch, one way or another, the coming 992 billion net Treasury issuance will serve as a trigger for the next market shock, one which the Fed will quickly reverse by expanding the already unlimited QE by over $3 trillion on very short notice.

The only question we have is whether this will be the market crash that the Fed uses to unveil it will also buy equity ETfs next, or if Powell will save this final bullet in its ammo for whatever comes next.