La Banque Centrale Suisse achète ouvertement les actions des GAFAM (Google Amazon, Facebook, Apple, Microsoft)...

On commence à comprendre pourquoi ces actions ont surperformé, puisque de nombreux Hedge Funds ont parié sur cette divergence entre les GAFAM (en français c'est Google Amazon, Facebook, Apple, Microsoft ,en anglais ont dit plutôt les FAAMG)

L'un de ces "hedge funds" est en fait la banque centrale suisse, qui, comme la banque centrale japonaise, achète ouvertement des actions (contrairement à la FED ou la BCE, qui s'en cache, alors qu'elles soutiennent les indices actions par d'autres moyen.

Sur qui allez-vous parier ?

Pour ma part, je pense que les GAFAM peuvent encore soutenir le marché encore quelques temps, mais que la divergence avec le reste de l'économie finira par disparaitre de façon assez violente...

-----------------------------------------

Voici les détails via Zerohedge :

As Markets Crashed, The Swiss National Bank Went On A FAAMG Buying Spree

It used to be a running joke among traders that when markets crash, central banks step in - either directly or in the case of the Fed indirectly via Citadel - and buy stocks to prop up the market and short up confidence. That joke is now the truth.

Now that the Fed is openly buying corporate bonds and fallen angels, what was once absurd humor has become sad reality. And while we wait for the Fed to admit it too will be buying stocks soon - we just need that pesky next crash before Powell commits - other central banks have no such qualms.

Take the SNB.

We previously reported that the hedge fund that is not only publicly traded but also moonlights as the Swiss central bank, which allows it to print money and effectively purchase any security it wishes with a zero cost basis suffered its biggest loss in history, reporting a loss of $32.7 billion on its massive equity portfolio. Yes, the SNB along with the BOJ, is unique in that it does not pretend to not buy stocks, and does so quite openly.

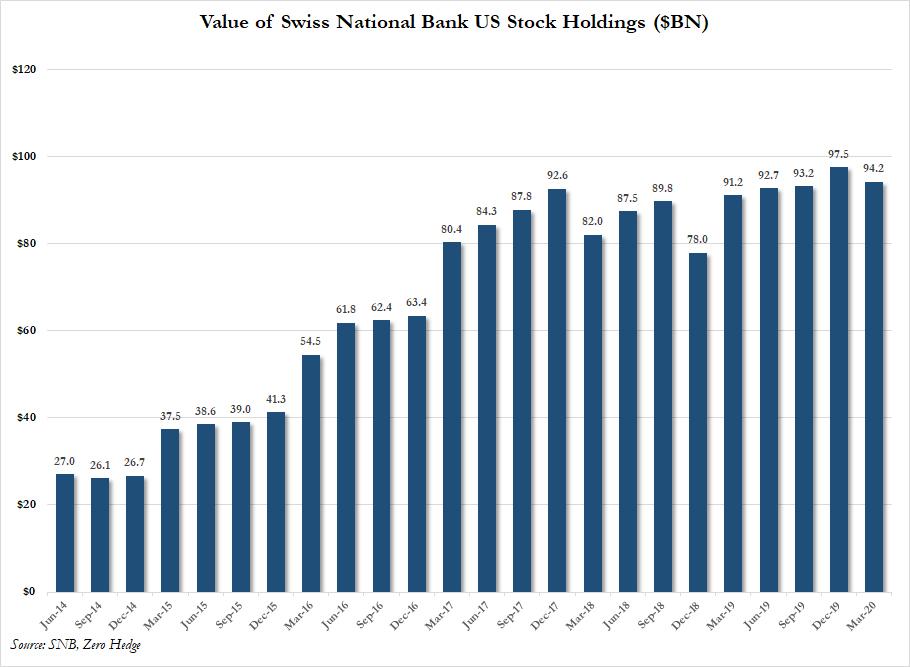

So openly, in fact, that in the past 5 years, the value of its US equity holdings increased more than threefold, from $26.7 billion in Dec 2014 to $97.5 billion in Dec 2019.

What about in the first quarter of 2020 when after hitting an all time high, stocks crashed in March?

As one can see in the chart above, the total value of SNB stock holdings barely budged from Q4 2019 to Q1 2020 despite the 30% crash in the market in March.

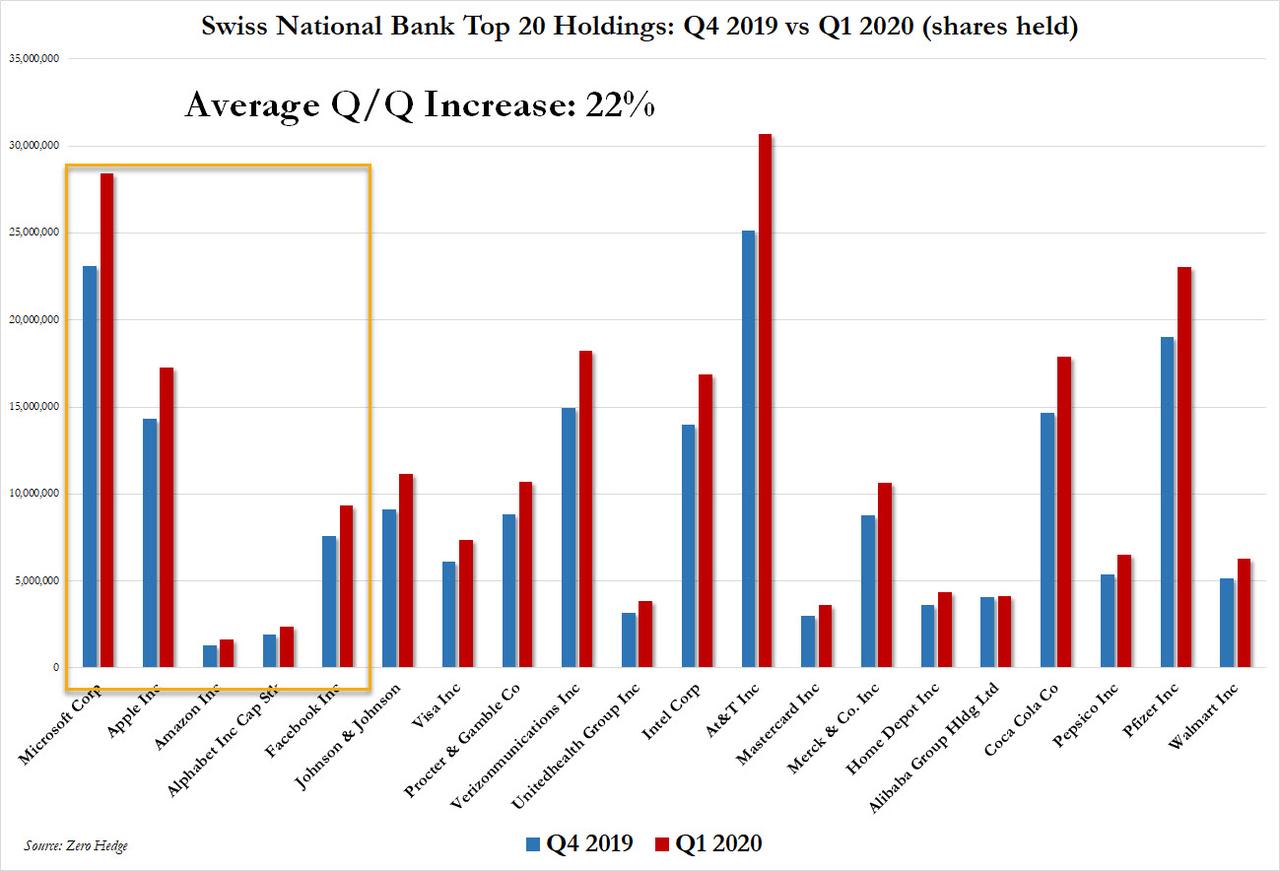

How is that possible? Simple: after the SNB kept its total holdings relatively flat for the past year, conserving its dry powder for just the right occasion, said occasion materialized in March, and the Swiss National Bank went on a buying spree as markets crashed, adding roughly 22% (on average) to its top positions.

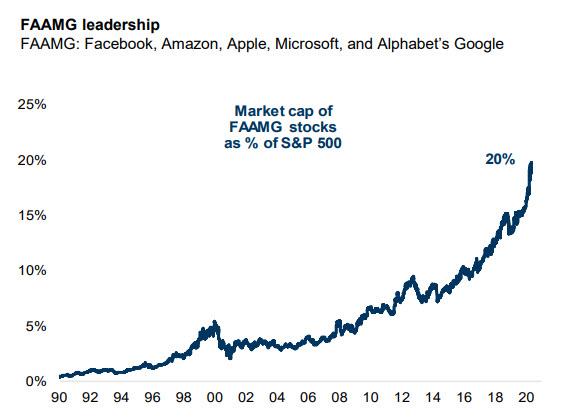

Also according to the SNB's latest 13F, as of March 31, the central bank owned $4.5 billion in Microsoft shares, $4.4 billion in Apple, $3.2 billion in Amazon, $2.7 billion in Google and $1.6 billion in Facebook, also known as the FAAMG stocks which as everyone knows by now, have become the market leaders, accounting for over 20% of the S&P's market cap.

And the punchline: the SNB added approximately 22% to its holdings of each of the FAAMGs in Q1 as follows:

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

MSFT: +23%

AAPL: +21%

AMZN: +23%

GOOGL: +22%

FB: +23%

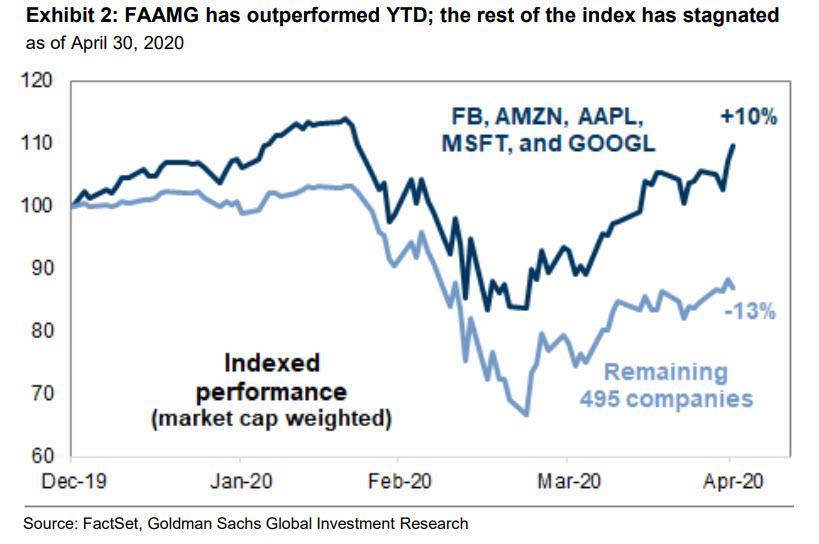

So for all those wondering who was going crazy bidding up all the megatech names, which are now up more than 10% YTD while the rest of the market is down 13%...

... even as even Warren Buffett sat on the sidelines waiting for the other shoe to drop, now you know and all you need to replicate the SNB's performance and buy FAAMGs without a care in the world, is your own (legal) printing press to print digital money out of ones and zero and buy anything and everything in the name of preventing the system from collapsing.

Source: SNB