Après une hausse record, les prix du pétrole s'effondrent alors qu'une nouvelle querelle éclate entre les Saoudiens et la Russie

Après une hausse record, les prix du pétrole s'effondrent alors qu'une nouvelle querelle éclate entre les Saoudiens et la Russie; La Réunion de Lundi de l'OPEP est annulée. Rétrospectivement, le trading sur un tweet Trump n'a peut-être pas été la meilleure idée.

Source: Zerohedge.

-----------------------

After Record Rally, Oil Faces Collapse As New Feud Erupts Between Saudis And Russia; Monday OPEC+ Meeting Cancelled

In retrospect, trading on a Trump tweet may not have been the best idea.

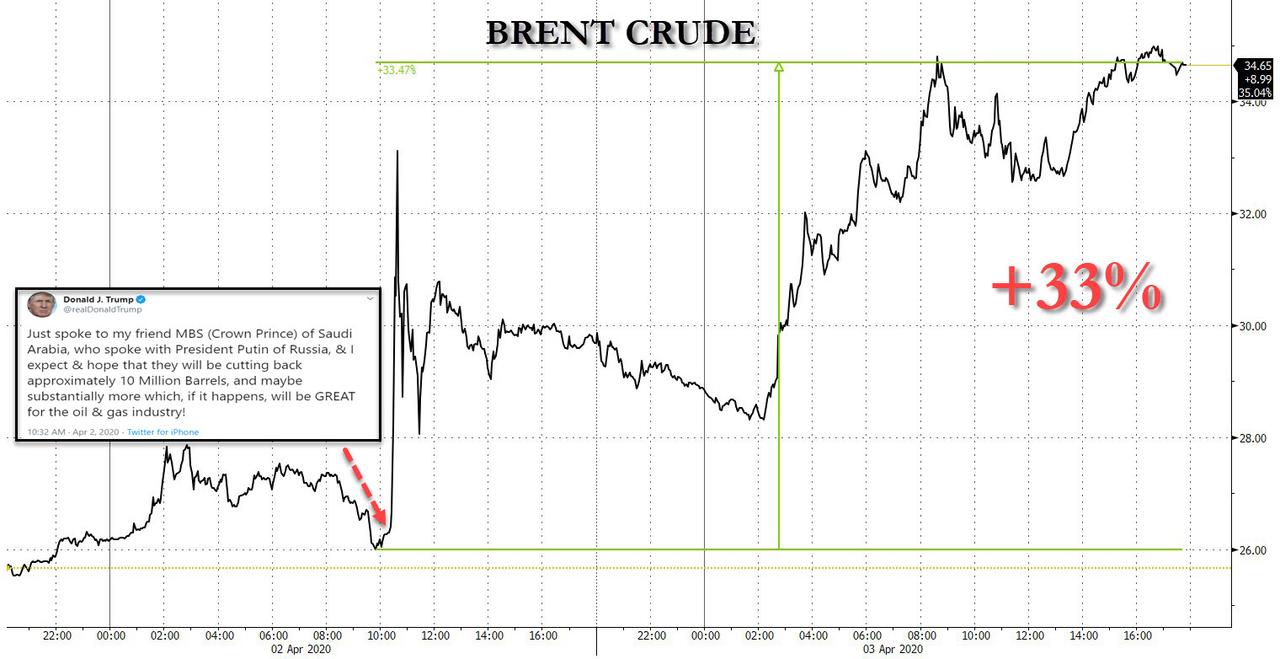

On April 2, in what initially appeared to be a belated April fool's joke, the US president tweeted "Just spoke to my friend MBS (Crown Prince) of Saudi Arabia, who spoke with President Putin of Russia, & I expect & hope that they will be cutting back approximately 10 Million Barrels, and maybe substantially more which, if it happens, will be GREAT for the oil & gas industry!"

What followed was the biggest rally in the price of oil ever, as countless oil shorts scrambled to cover their positions amid concerns there could be even a shred of truth to Trump's boast that the oil price war between Saudi Arabia and Russia could be coming to an end, especially since global oil demand had cratered by over 20% just as Saudi Arabia boosted its own output to a record 12mmb/d

One day later, on Friday, the surge continued after R-OPEC members saying they may indeed consider a 10mmb/d cut (which, as we also explained would not be nearly enough to balance the oil market but at least it was a start), with Putin admitting he had spoken with US President Trump saying "we are all worried about the situation" and that he is "ready to act with the US on oil markets" with 10mmb/d in oil production needed to be cut.

However, as his Russian energy minister, Alexander Novak, explained at the same time, any production cut would need to also include US shale producers , something that Trump was certainly not too keen on. As the WSJ reported, "Saudi Arabia and Russia won’t cut unless they get signals from U.S. producers they will reduce output, the officials said. But they added that official joint curbs would be more difficult to enact in the U.S. because of antitrust laws."

And so, the world was excitedly looking forward to the Monday's virtual R-OPEC conference where the question was whether Trump would agree to cut US production (and whether he even had the authority to enforce such a cut)

But before that, something happened that few noticed yet ended up being a gamechanger: among the other things Putin said on Friday, we reported that the Russian president was also kind enough to summarize the reasons for the oil price collapse which he blamed on the coronavirus, the lack of oil demand and, drumroll, the Saudi withdrawal from the OPEC+ deal.

“It was the pullout by our partners from Saudi Arabia from the OPEC+ deal, their increase in production and their announcement that they were even ready to give discounts on oil” that contributed to the crash, along with the coronavirus-driven drop in demand, he said.

“This was apparently linked to efforts by our partners from Saudi Arabia to eliminate competitors who produce so-called shale oil,” Putin continued. “To do that, the price needs to be below $40 a barrel. And they succeeded in that. But we don’t need that, we never set such a goal.”

As it turns out, Saudi Arabia was - and remains - quite sensitive to accusations over who was responsible for the failure of the March 5 Vienna summit which ended up in Russia refusing to be forced into even bigger production to appease Saudi Arabia, and prompted Saudi Arabia to unleash a historic oil glut.

In a statement early on Saturday, the Saudi Foreign Minister Prince Faisal bin Farhan said the comments noted above by Putin laying blame on Riyadh for the end of the OPEC+ pact between the two countries in March were “fully devoid of truth.”

“Russia was the one that refused the agreement” in early March, the Saudi foreign ministry said. “The kingdom and 22 other countries were trying to to persuade Russia to make further cuts and extend the agreement.”

Which just happens to be more fake news, and the reason why Russia balked is because it was faced with what it - correctly - viewed was a hostile ultimatum by OPEC. As the NYT reported:

After talks with OPEC members in Vienna, Russia’s energy minister, Alexander Novak, returned to Moscow for consultations on Thursday. In his absence, OPEC officials met and came up with what amounted to an ultimatum. The group as a whole would trim production by 1.5 million barrels a day, or about 1.5 percent of world supply. OPEC, meaning largely the Saudis, would make the bulk of the cutbacks, one million barrels, as long as Russia and other producers trimmed the rest.The gambit was “something of a boss move,” said Helima Croft, an analyst at RBC Capital Markets, but it backfired badly. Russia had played hard to get before, but this time Mr. Novak was not playing. The answer was “no” again, and the Saudi oil minister, Prince Abdulaziz bin Salman, and other officials headed back to their hotels with no results and no communiqué.

Needless to say, Saudi Arabia was not used to getting no for an answer, and so it responded by effectively disbanding OPEC, even as it continued to blame Russia for doing so: as Bloomberg reports, "since the original OPEC+ deal fell apart at a March 5 meeting in Vienna, the Saudis have argued Russia decided to walk away and was first to say countries were free to pump as much as possible."

“The Russian Minister of Energy was first to declare to the media that all the participating countries are absolved of their commitments,” said Prince Abdulaziz, the energy minister and half-brother of Crown Prince Mohamed bin Salman. “This led to the decision by countries to raise their production in order to offset lower prices and compensate for their loss of returns.”

In any case, Saturday's direct criticism of Putin was echoed in a statement by Energy Minister Prince Abdulaziz bin Salman, and threatened any fleeting hope of an agreement to stabilize the collapsing oil market after President Trump devoted hours of telephone diplomacy last week to brokering a truce in the month-long price war between Moscow and Riyadh.

As an immediate result, the OPEC+ (or R-OPEC) meeting scheduled for Monday has been delayed as Riyadh and Moscow have discovered a new reason to feud: arguing over who’s to blame for the collapse in oil prices.

And while the alliance is tentatively aiming to hold the virtual gathering on April 9 instead of Monday as it previously intended, a Bloomberg source said with another noting that "producers need more time for negotiations"; in other words, it is unclear if the meeting will take place at all now that the diplomatic spat has reached the highest levels of the world's top oil producers.

And, as we discussed on Friday, beyond this latest diplomatic spat, Saudi Arabia and Russia have indicated they want other oil countries to join in any output cuts, complicating efforts to call a meeting, the delegate said, asking not to be named discussing diplomatic matters.

“We always remained skeptical about this wider deal as U.S. producers cannot be mandated to cut,” said Amrita Sen, chief oil analyst at consultant Energy Aspects Ltd. “If so, Russia doesn’t come to the table. And if everyone doesn’t cut, Saudi Arabia’s long held stance is that they will not cut either.”

A delay is “not a good sign,” said Ayham Kamel, head of Middle East and North Africa at the Eurasia Group consultancy. “This entirely plays negatively for the discussions.”

“Part of Putin’s comments are about saving face and also justifying why the oil price crashed and partly to deter criticism from the U.S. Putin doesn’t want to be blamed for any losses in the U.S. energy industry. It seems to me that there’s both a defensive effort to shield from criticism abroad for both the Saudis and the Russians,” Kamel said.

The prospect of a new deal spurred a 50% recovery in benchmark oil prices last week as traders saw some relief from the catastrophic oversupply caused by a lockdown of the world’s largest economies, in a bit to halt the coronavirus pandemic. With billions of people forced to stay at home, demand for gasoline, diesel and jet has collapsed by about as much 35 million barrels a day.

Which means that absent either Putin or MBS making some major concessions in what would be seen as a glaring sign of weakness, the record oil rally is about to go in reverse because the primary reason behind the oil price crash still looms: the world running out of oil storage in months if not weeks, and is why the Saudis, who have ramped up production to a record 12 million barrels a day in the past month and massively discounted the price of their oil, have insisted a new agreement must involve significant contributions from all OPEC+ nations and major producers outside the coalition, including the U.S. and Canada.

“No one had expected such a total collapse in the oil market,” said Fyodor Lukyanov, head of the Council on Foreign and Defense Policy, a research group which advises the Kremlin. “Saudi Arabia and Russia have lost control of the situation. Tearing up the OPEC+ deal caused a lot of hurt feelings in Moscow and Riyadh, for Putin and MBS. That makes things more difficult, they have to get over that while not losing face. That’s why they’re both pointing the finger at each other."