Weak Housing = Anemic Recovery

The post credit crisis recovery has been anemic in terms of GDP and soft in terms of job creation — despite the massive Fed stimulus this entire time.

The post credit crisis recovery has been anemic in terms of GDP and soft in terms of job creation — despite the massive Fed stimulus this entire time.

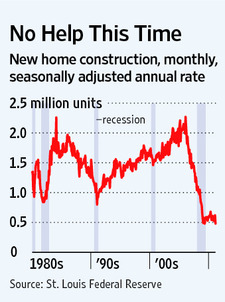

Given the stock of excess housing built up during the boom, and how leveraged home-owners became during that period, it is no surprise that Housing remains an under-performing sector today.

Exactly how much that is impacting the economy can be seen in a recent study:

“Residential investment, which includes new-home construction as well as renovations and broker commissions, accounted for 19% of GDP growth on average in the first two quarters of postwar recoveries, according to Harvard’s Joint Center for Housing Studies. In turn, GDP growth during those periods averaged nearly 7% at an annualized pace.”

Hence, the current recovery is likely to remain sub-par for the foreseeable future . . .

>

Source:

Recipe for Recovery Lacks Housing’s Spice

Kelly Evans

WSJ, APRIL 18, 2011

http://online.wsj.com/article/SB10001424052748703648304576265302479318880.html

Commentaires