US Money Supply vs Precious Metal Production (October 2020)

Visualizing U.S. Money Supply vs. Precious Metal Production in the COVID-19 Era

By Jenna Ross

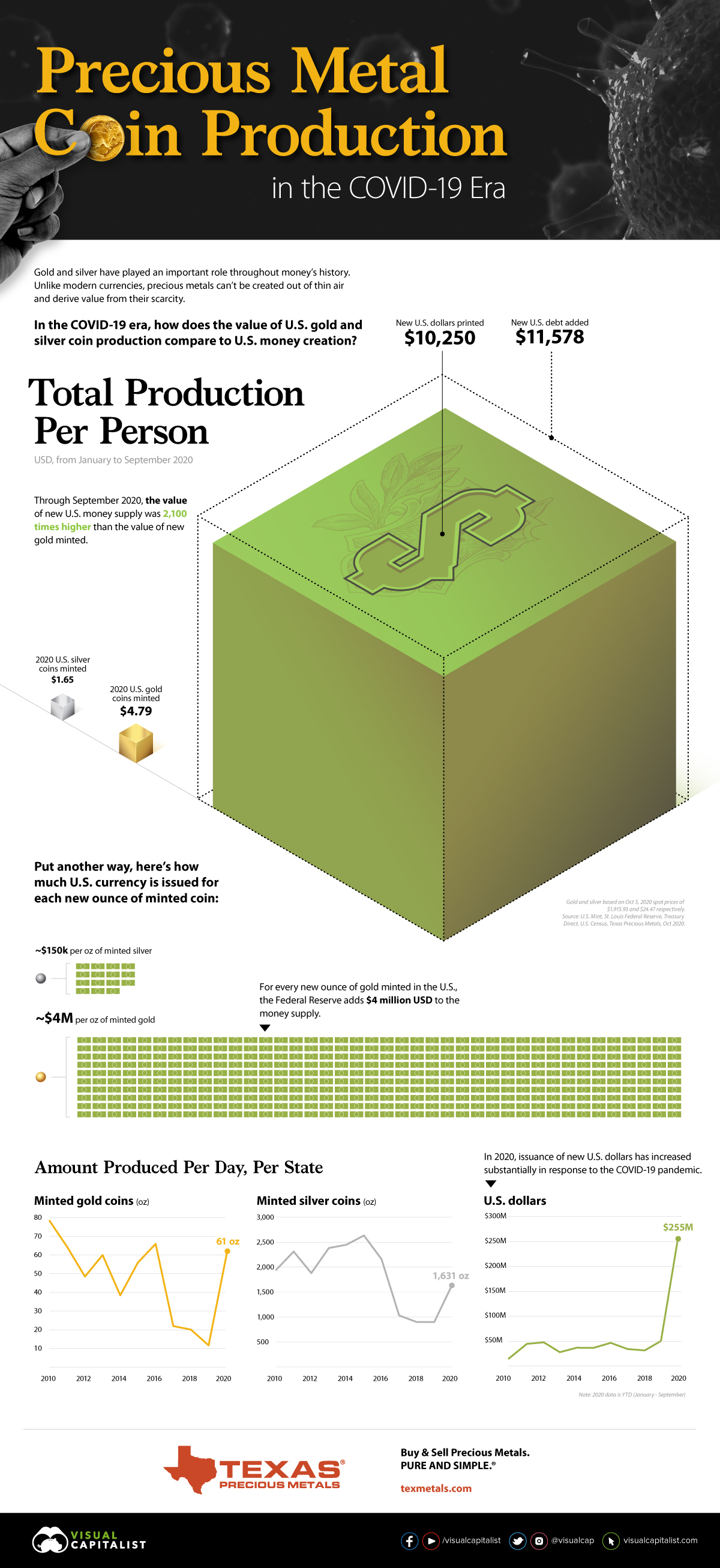

U.S. Precious Metal Coin Production in the COVID-19 Era

Gold and silver have played an important role in money throughout history. Unlike modern currencies, they can’t be created out of thin air and derive value from their scarcity.

In the COVID-19 era, this difference has become more prominent as countries print vast amounts of currency to support their suffering economies. This graphic from Texas Precious Metals highlights how the value of U.S. precious metal coin production compares to U.S. money creation.

Year to Date Production

In this infographic, we have calculated the value of money supply added as well as bullion minted, and divided it by the U.S. population to get total production per person. Here’s how the January-September 2020 data breaks down:

Total (Ounces)Dollar ValueDollar Value Per PersonU.S. Gold Ounces 826,000 $1.6B $4.79

U.S. Silver Ounces 22,261,500 $544M $1.65

U.S. Money Supply $3.4T $10,250.16

U.S. Debt $3.8T $11,578.36

Gold and silver dollar values based on Oct 5, 2020 spot prices of $1,915.93 and $24.47 respectively.

The value of new U.S. money supply was more than 2,100 times higher than the value of new gold minted. Compared to minted silver, the value of new U.S. money supply was over 6,000 times higher.

Production Per Day, Per State Over Time

Here’s how production has changed on a per day, per state basis since 2010:

20102020 YTD (Jan-Sep)Min-Max Production, 2010-2019 Minted Gold Coins 78oz 61oz 12oz-78oz

Minted Silver Coins 1,945oz 1,631oz 899oz-2,633oz

U.S. Dollars $19M $255M $19M-$50M

Year to date, U.S. precious metal coin production is within a normal historical range. If production were to continue at the current rate through December, gold would be above historical norms at 81 ounces and silver would be within the normal range at 2,175 ounces.

The issuance of U.S. dollars tells a different story. Over the last nine months, the U.S. has already added 400% more dollars to its money supply than it did in the entirety of 2019—and there’s still three months left to go in the year.

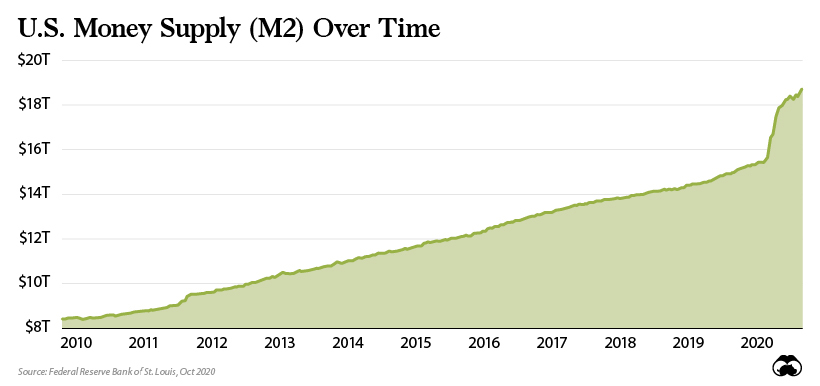

A Macroeconomic View

Of course, current economic conditions have been a catalyst for the ballooning money supply. In response to the COVID-19 pandemic, the U.S. government has issued over $3 trillion in fiscal stimulus. In turn, the U.S. Federal Reserve has increased the money supply by $3.4 trillion from January to September 2020.

Put another way, for every ounce of gold created in 2020 there has been $4 million U.S. dollars added to the money supply.

The question for those looking for safe haven investments is: which of these will ultimately hold their value better?

Commentaires