La deuxième vague du Krach est pour bientôt : le Pétrôle montre le chemin...

La deuxième vague du Krach est pour bientôt : le Pétrôle montre le chemin...

N'oubliez pas que le paroxysme de ce krach en Mars est arrivé non pas à cause des nouvelles sur le virus mais à cause de l'échec des négociations de l'OPEP+ au cours du week-end du 7-8 Mars qui a précédé l'une des pires semaines de l'histoire boursière.

Moralité, il ne s'agit pas QUE du Coronavirus.

Les conséquences économiques d'un retournement de conjoincture (dont les prémices se faisaient déjà sentir avant Mars) n'en sont qu'au début, lorsque les statistiques économiques vont être publiées.

A mon avis il faut utiliser le rebond actuel pour sortir à moindre frais des positions encore acheteuses. En gros, entre maintenant et la mi Mai...

Quelques arguments supplémentaires en provenance de ZeroHedge (source : Bloomberg's Cameron Crise), qui analyse la correlation et le décalage entre les cours du Pétrole et du S&P500.

-----------------

The Last Time This Happened To Oil, Stocks Collapsed 30%

While the velocity of stock markets' rebound is making headlines, it's the energy complex that is screaming at the top of its lungs - something is wrong, very wrong.

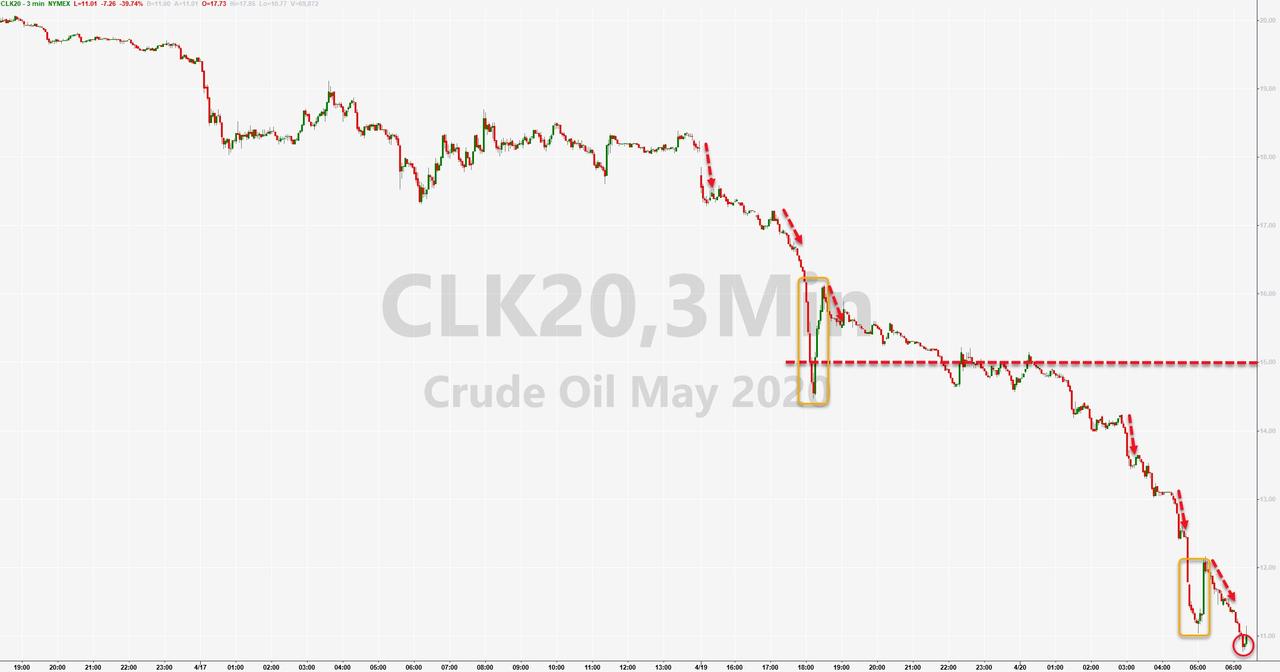

A total bloodbath in black gold this morning as a combination of fundamental (weaker and weaker demand outlooks as global GDP forecasts collapse and headlines that Russia actually increased supply by 1% in the last 3 days) and technical (massive flows into USO - the Oil ETF - and shifts in the way the ETF is constructed to use 2nd month futures, combined with the contract roll) has sent the front-month (May) WTI futures down a stunning 40%-plus....

With the May contract trading with an $10 handle...

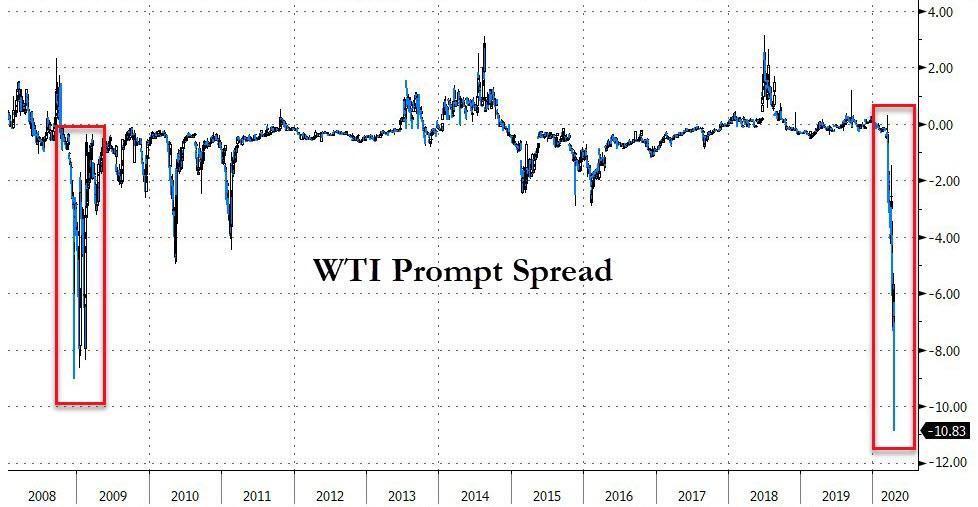

Most critically, the prompt-spread (between May and June in this case) has collapsed to record lows...

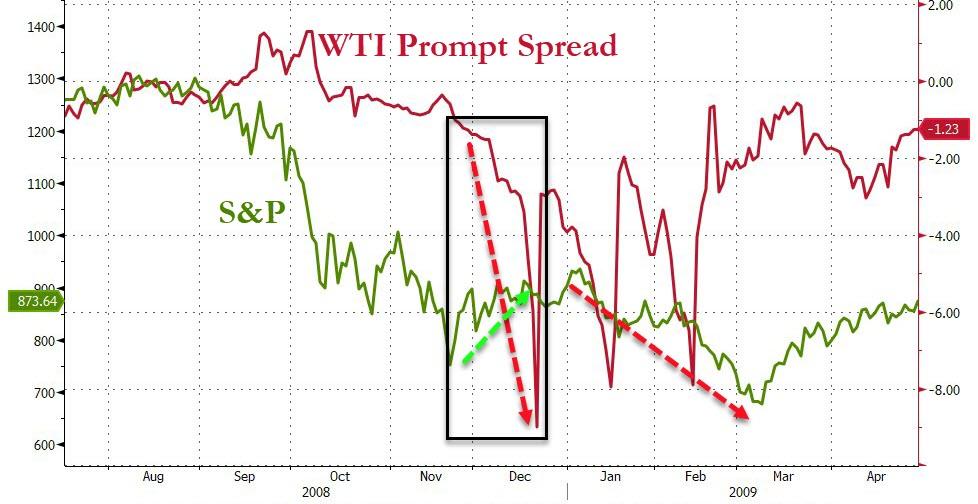

We have seen this pattern before - as the chart above suggests. Bloomberg's Cameron Crise also notes that the last time we saw such a huge spike the prompt-spread was December 2008... which just happens to coincide with an equally impressive surge/rebound in US equity markets (27.5% on a trough to peak basis from mid-November to early January)... only to end very badly around 30% lower...

Coincidence that we are seeing the exact same pattern play out as stocks soar and oil's curve implodes?

As Crise warns, maybe the oil market is offering a warning of just how significant the economic damage will be - damage that you could argue is no longer reflected in the price of equities (which seem entirely focused on The Fed put and vaccine/treatment hopes).

Trade accordingly.