Nouvelle vague baissière suivie d'une hausse hyper-inflationniste ?

FX weekly

Article by Andreas Steno Larsen and Joachim Bernhardsen

Ingves adopted a Plato-like rhetoric at the presser, saying “that all he knew was that he didn’t know anything”. Until Friday, equity markets partied like Ingves, Lagarde and Powell had invented a vaccine, but all they do is print. We remain bearish

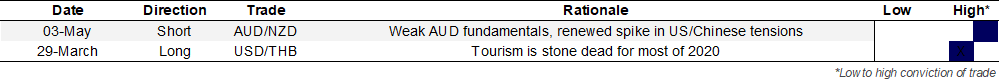

Table 1: Our current convictions

Quote of the week:

"All I know is that I know nothing" Plato as adopted by Riksbank Governor Stefan Ingves

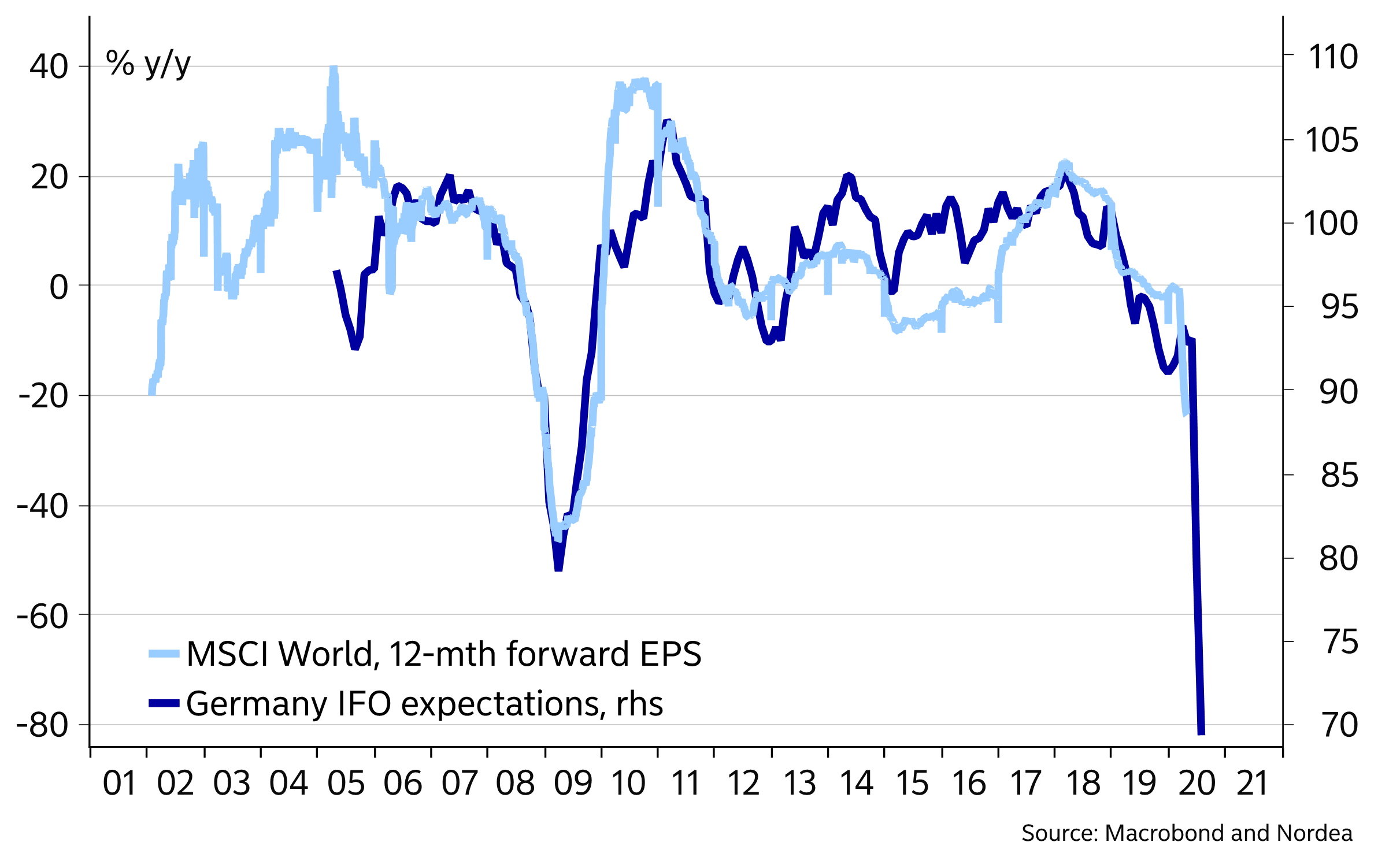

You may rightfully ask; “How’s that Corona thing going”? We have even ad hoc’d our own Corona daily as the markets seem to be comfortable with the flattening case curve from a momentum perspective. We all seem to cheer on the prospects of a gradual reopening paired with bizarre amounts of central bank- and fiscal stimulus. Happy days, right? We are not so sure. Is it really feasible to CTRL+P profits? Looking at it broadly, EPS may need to be revised down at least 40-50% YoY in a quarter from now, but it seems like most equity analysts have been sipping directly from the magic central bank spring (Certainly less strong than what Elon Musk had the other day) as they look for a “mere” -20% EPS growth this year. It is historically naïve, sorry, optimistic.

If expected earnings are slashed in the way that we find feasible, 12m expected P/E’s will either have to find bizarre new all-time-highs (as 2020 is deemed an outlier) or else equities will have to give in again. We lean towards the latter.

Chart 1: IFO vs. EPS – time to slash those estimates big time..

An overlooked angle on the Corona-lockdowns is that it emphasizes the already growing barriers between the “Elite” and the “Workers.” The big cities are the main epicenters (also per capita) of the Covid-19 virus, while containment measures have been forced upon entire states and countries. Regions with low density have been faced with the same kind of measures as more dense areas, even if these regions haven’t seen a material spread of the virus. One size fits all, even if density has proven to be maybe the biggest issue when trying to contain the virus spread. The current virolocracy could be seen as both extraordinary elitist and gentrification-supportive in its nature, since a much larger part of the urban population can work from home etc.

“Workers lifes matters” have seen tailwind in important swing states such as Michigan as most of the spread has been seen around Detroit, while the less dense parts of the state haven’t seen any material spread of the virus. The movement argues that the big cities are relatively better off in the lockdowns, and that less dense areas should never have been forced to close the economy anyway. It is KEY for The Donald to win over such “movements” if he wants to triumph in the election later this year. We (and also the Jay-man) don’t think the economy will be in a good shape by then, why The Donald needs something else to convince his base, in particular since wage growth could be about to fall of a cliff.

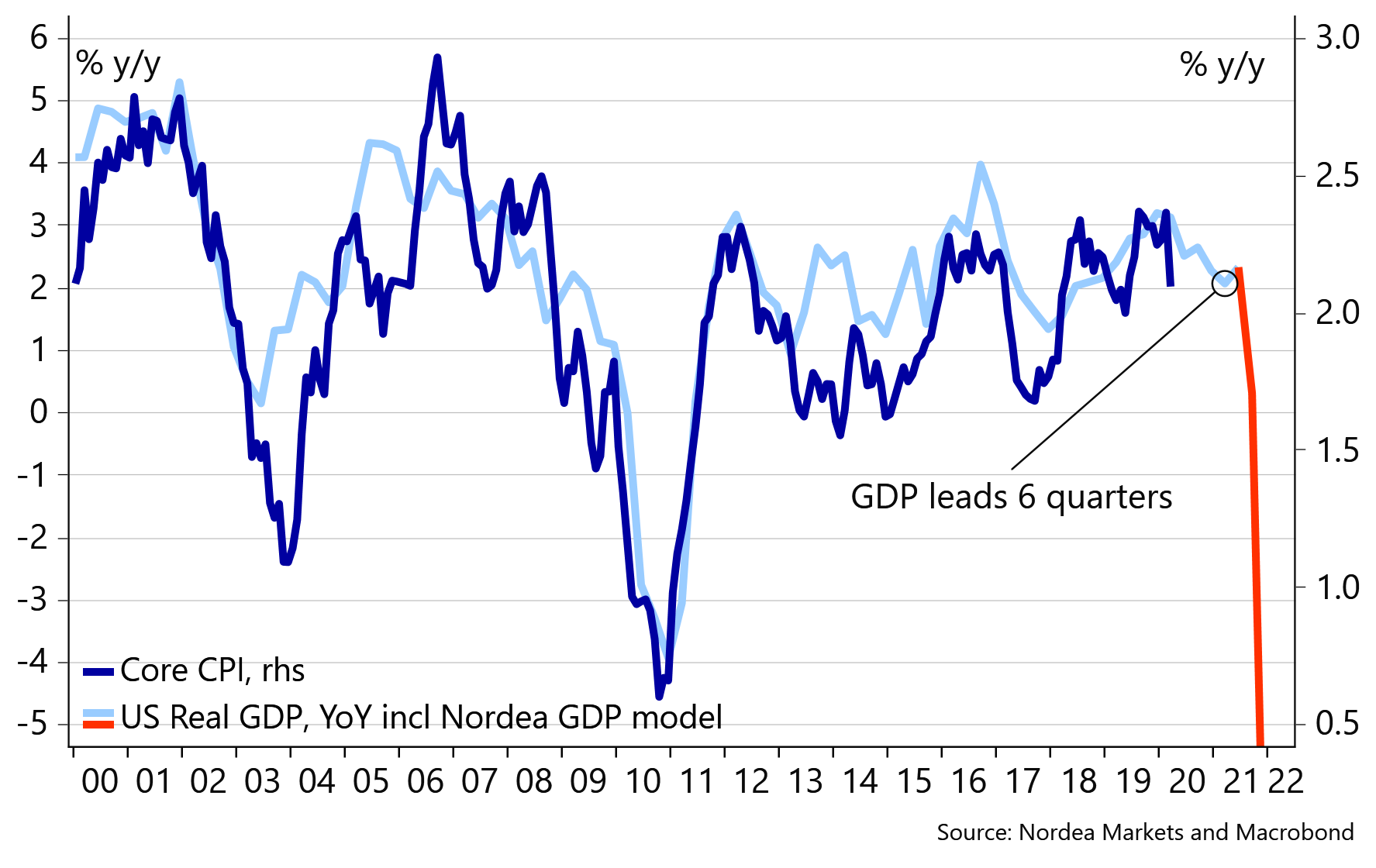

Core inflation (and wage growth) are cyclical laggards, which means that first i) activity comes to a halt, ii) commodity prices and headline inflation drop, iii) workers are laid off in size, iiii) wages and prices decelerate or even decline. We are probably in between phase three and four now, why news on prices and wages will be the next to surprise negatively during H2-2020 and in to 2021 (in Q1 and Q2 activity data has been the negative surprise).

Chart 2: Core inflation (and wage growth) will start to disappoint negatively during H2-2020

Trumps weapon of choice (to win over the workers again) could be China-bashing in combination with renewed isolationism. Trump deeming Chinese equities a "national security risk" is not really newsworthy since the EU has been talking about the same thing for a while – though, mostly with a focus on blocking potential hostile Chinese take-overs of Euro area companies, but it suddenly seemed to revive the focus on geopolitical risks on the other side of the Corona mess. The US/China trade deal has been stone-dead for months already (it was in fact dead already from the outset), so that is in itself not exciting, but no-one had an interest in saying so until after the US election. The corona virus may have offered Trump a chance to "reveal" that the trade deal is 100% off, and to take a renewed China aggressive stance into the election instead.

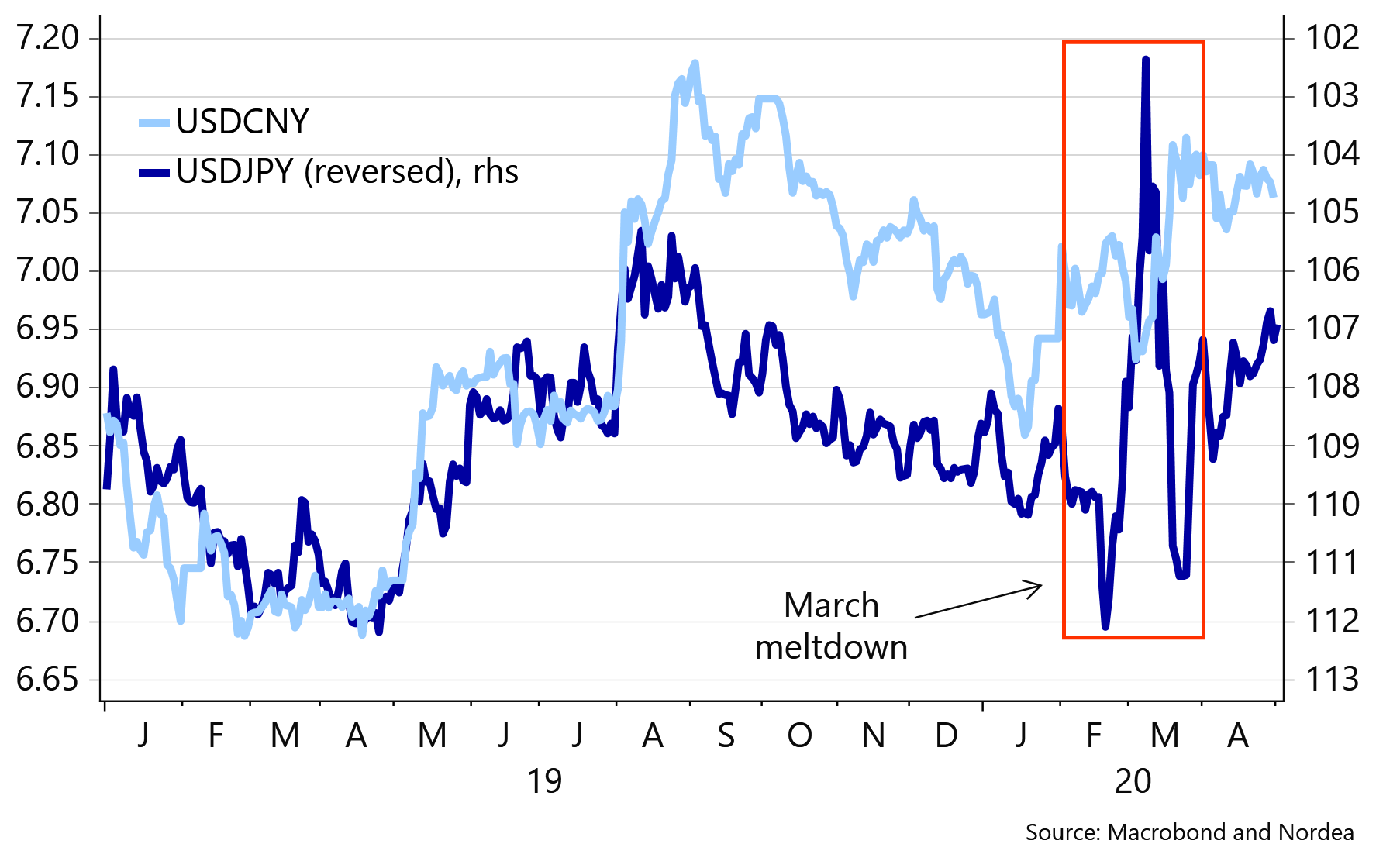

This is bad for Asian FX (versus USD), AUD and NZD (short AUD/NZD likely the smartest bet) and risk assets and equities in general. Before the March melt-up in markets, USD/CNY was THE global bellwether for risk appetite, and it may very well return as such very soon. You should buy USD/CNY (and sell risk assets) on tariff threats.

Chart 3: USDCNY was THE global risk bellwether until the March melt-down

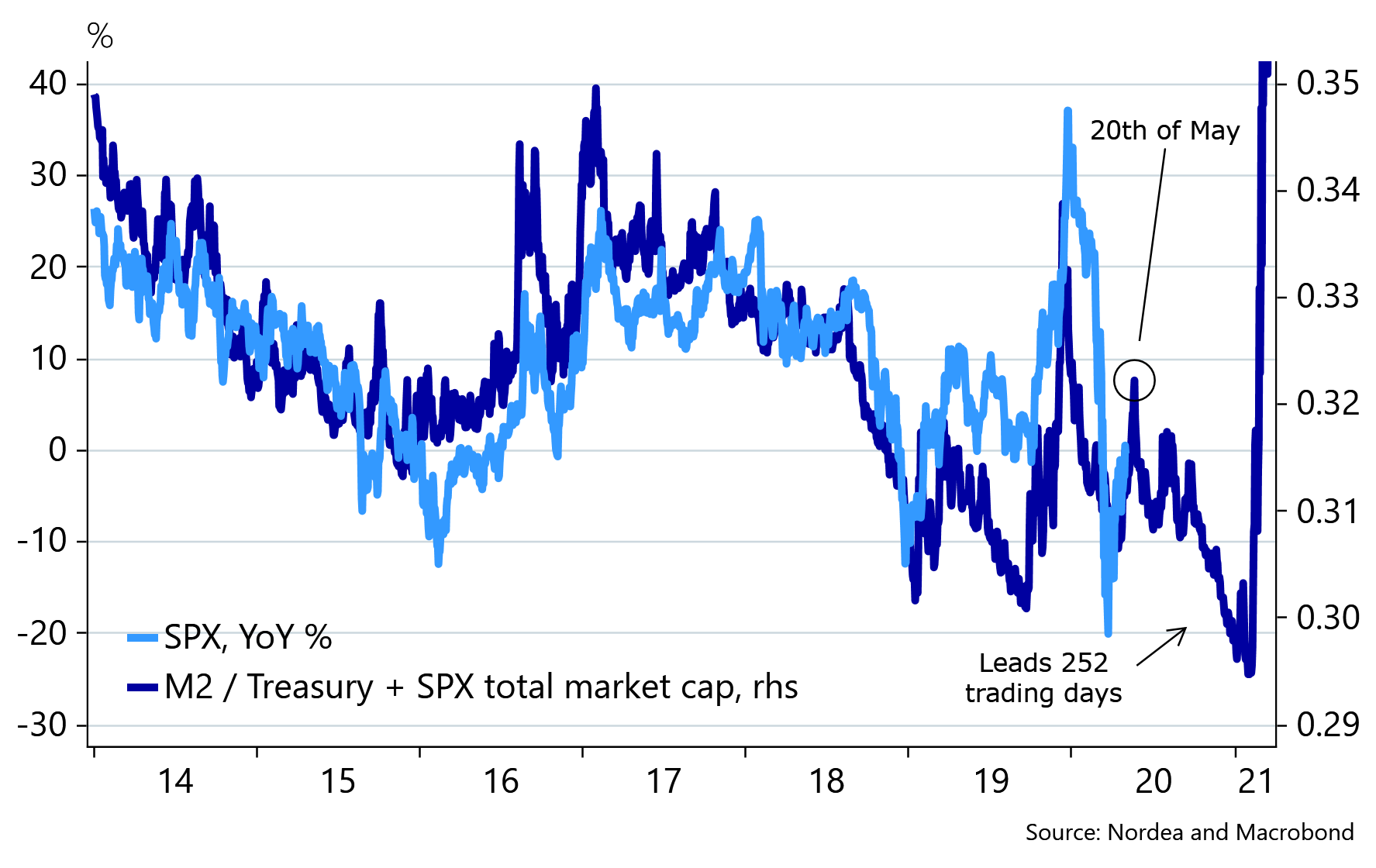

“Sell in May and go away” is maybe one of the most annoying investment clichés but it could prove to work again this year, if lead/lag patterns from the M2 development to risk asset performance persist. As M2 improves in the US, it is i) a result of much easier Fed policies and ii) a demand for credit that is suddenly revived due to the Corona lock-downs, but it usually also comes with important bearing for risk assets after a while. Judging from usual lead/lag patterns, lackluster M2 developments from 2019 should still act as a drag on risk assets from May and into the second half of the year, while 2021 looks to be the most “ketchupped” market ever, as the bonanza of policy measures will leave too much money chasing too few assets.

Chart 4: Too much money chasing too few assets in 2021?

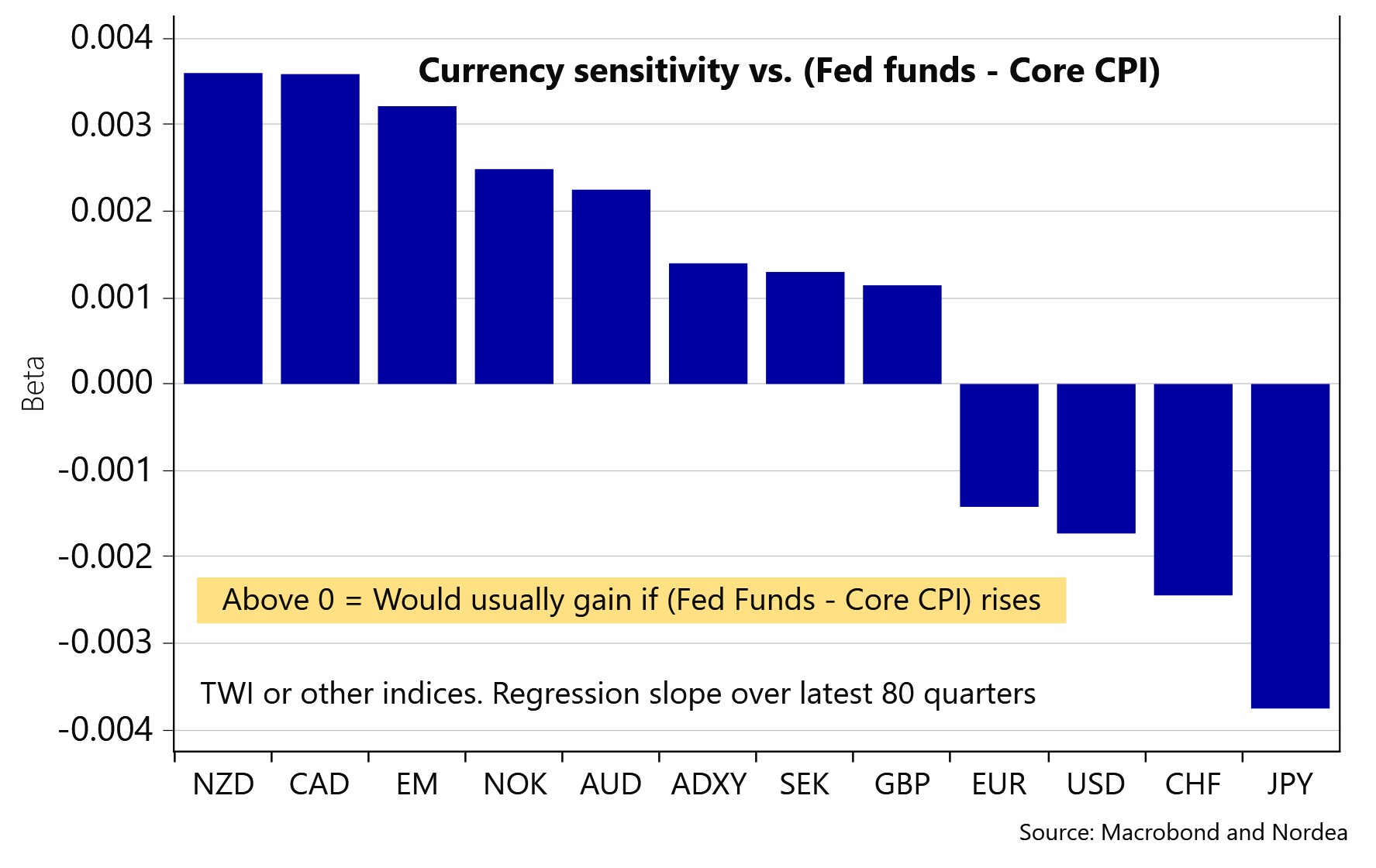

So, what should you buy in FX space, if we are right that an exorbitant ketchup effect arrives in late 2020 or early 2021? NZD is likely THE bet in G10, while JPY could prove to be the loser (we reached profit levels in short CHF/JPY over the week). The below is a heatmap of FX beta to rising spot core real rates (Fed funds minus Core CPI) as we will likely be faced with once Core CPI drops as a lagged result of rising unemployment. Why is “risk on” the name of the game when core real rates increase? Likely as the central banks (and in particular the Fed) have printed and eased their way out the mess by then, which leaves a weaker USD outlook and a stronger commodity outlook likely, once the dust settles. That is a story for later. Q2 and Q3 are likely to be driven by other, less positive, factors.

Chart 5: What to buy in FX space when the ketchup effect kicks in. Left is best, right is worst.

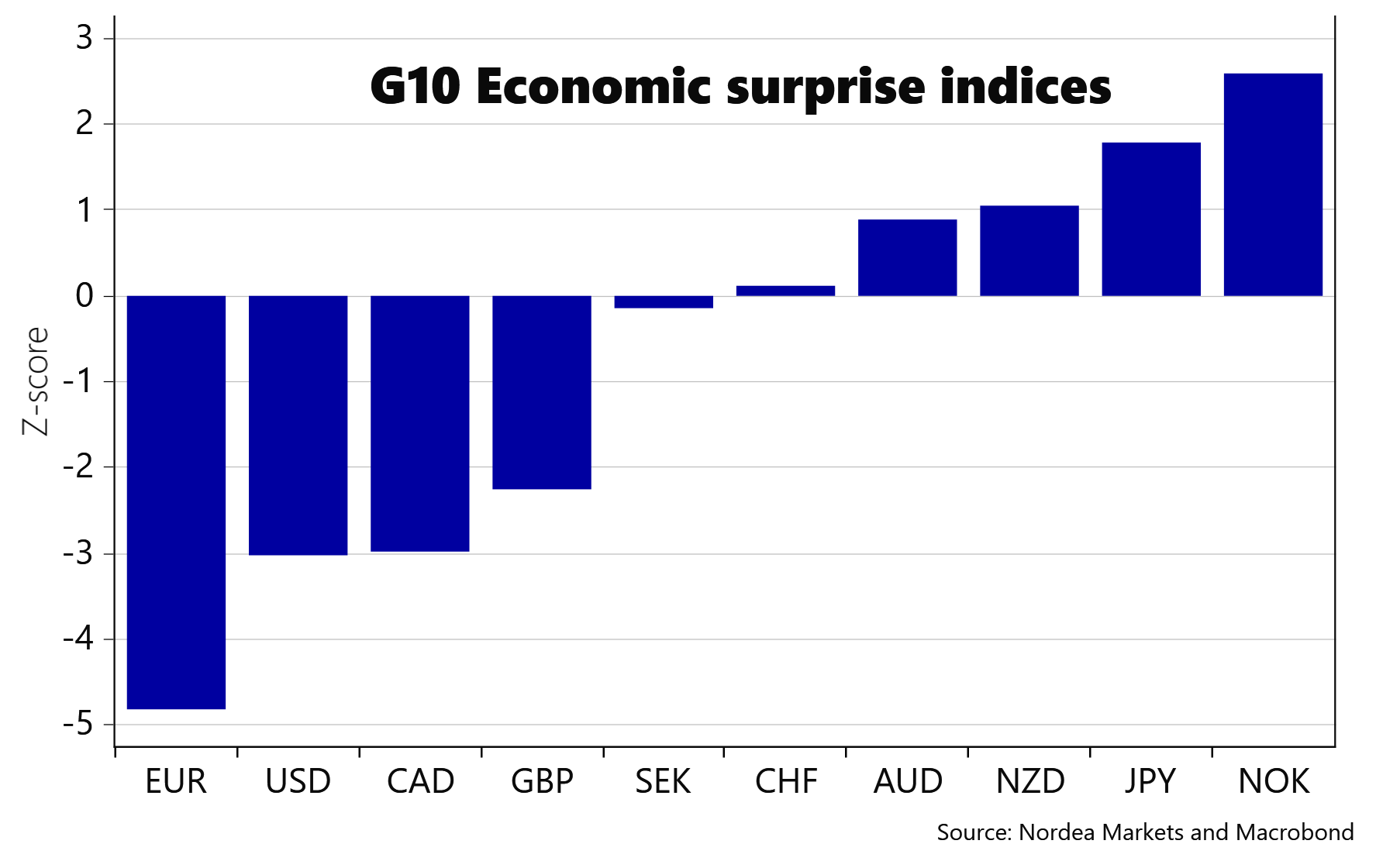

So, what are we looking at buying right now? The EUR surprise index is at the most depressed levels ever seen and essentially it cannot get any worse, why long EUR positions could be worth pondering for those who look for correctional patterns. AUD and NZD look overbought, in particular if the US/Chinese tensions are about to re-escalate with according setbacks for risk assets.

Chart 6: G10 surprise indices (buy left, sell right)

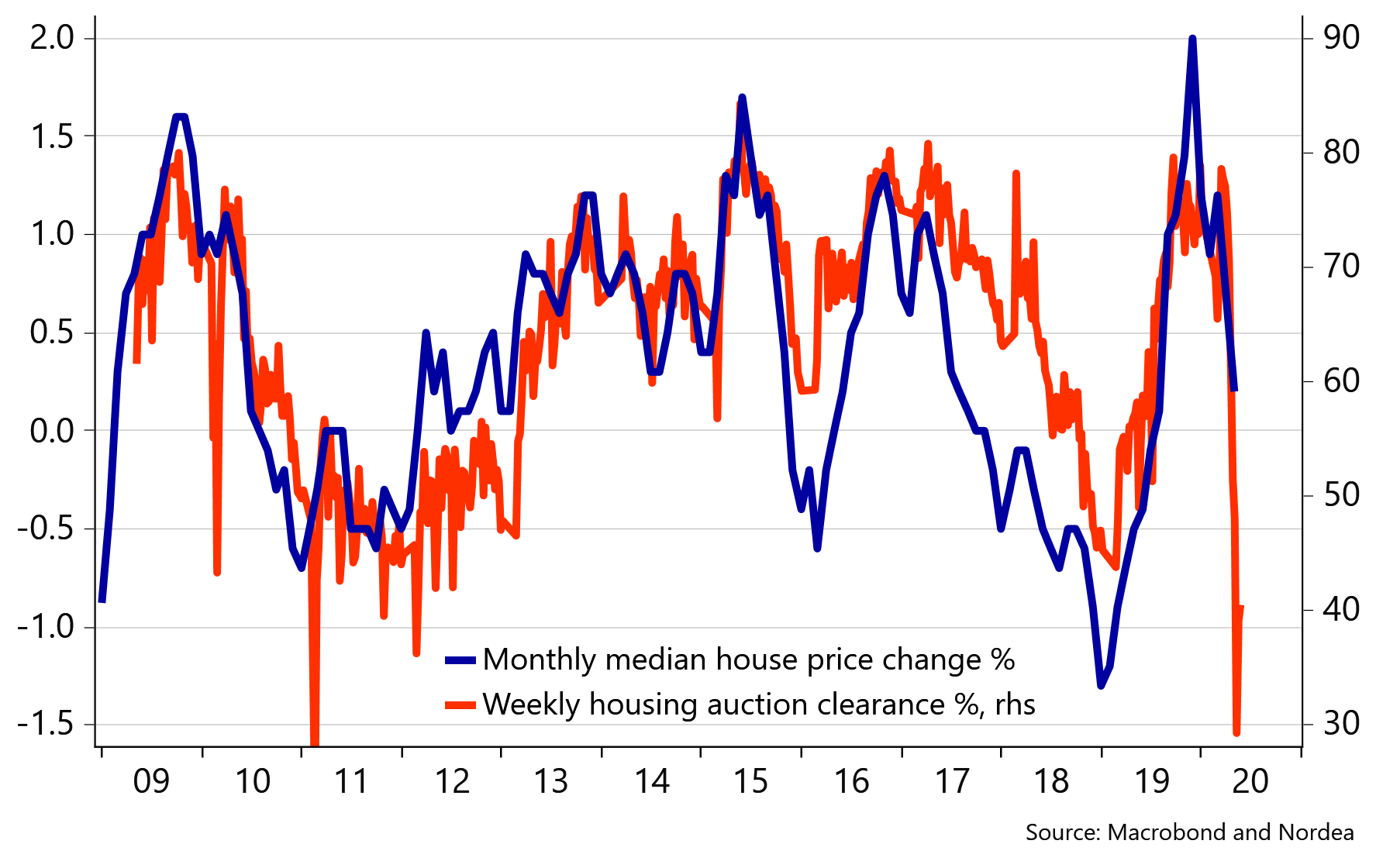

We prefer NZD to AUD as AUD has thrived due to a relative positive mood around China vs. RoW growth. AUD has traded like a rocket in recent weeks despite starring directly into a housing market abyss again. Current auction clearance data suggest that Australian house prices will drop (at least) 1.5% a month in the coming period. Ouch.

Chart 7: Auction clearance data suggest that Australian house prices will drop (at least) 1.5% a month

Technically, a short position in AUD/NZD looks compelling as the bearish channel since late-2017 remains intact. We opt to go short AUD/NZD with a target of 1.02 (and a S/L at 1.0820) on the cocktail of higher USD/CNY, weak domestic Australian fundamentals and wobbly risk appetite ahead.

Chart 8: Technically, a short position in AUD/NZD looks compelling

Scandi markets: Riksbank “All that we know is that we know nothing”

The Riksbank adopted a “who knows” approach to their updated projections this week with no real emphasis on a base case nor on a bias towards whether up -or downside risks are more material. Either this could be viewed as a deliberately hawkish tilt versus peers (most peers really stress downside risks) or else the Riksbank could be viewed as clueless. “All that we know is that we know nothing” is the short resumé of Governor Ingves’ press conference. Fair play from the Riksbank; some of us have had that feeling around them for a while.

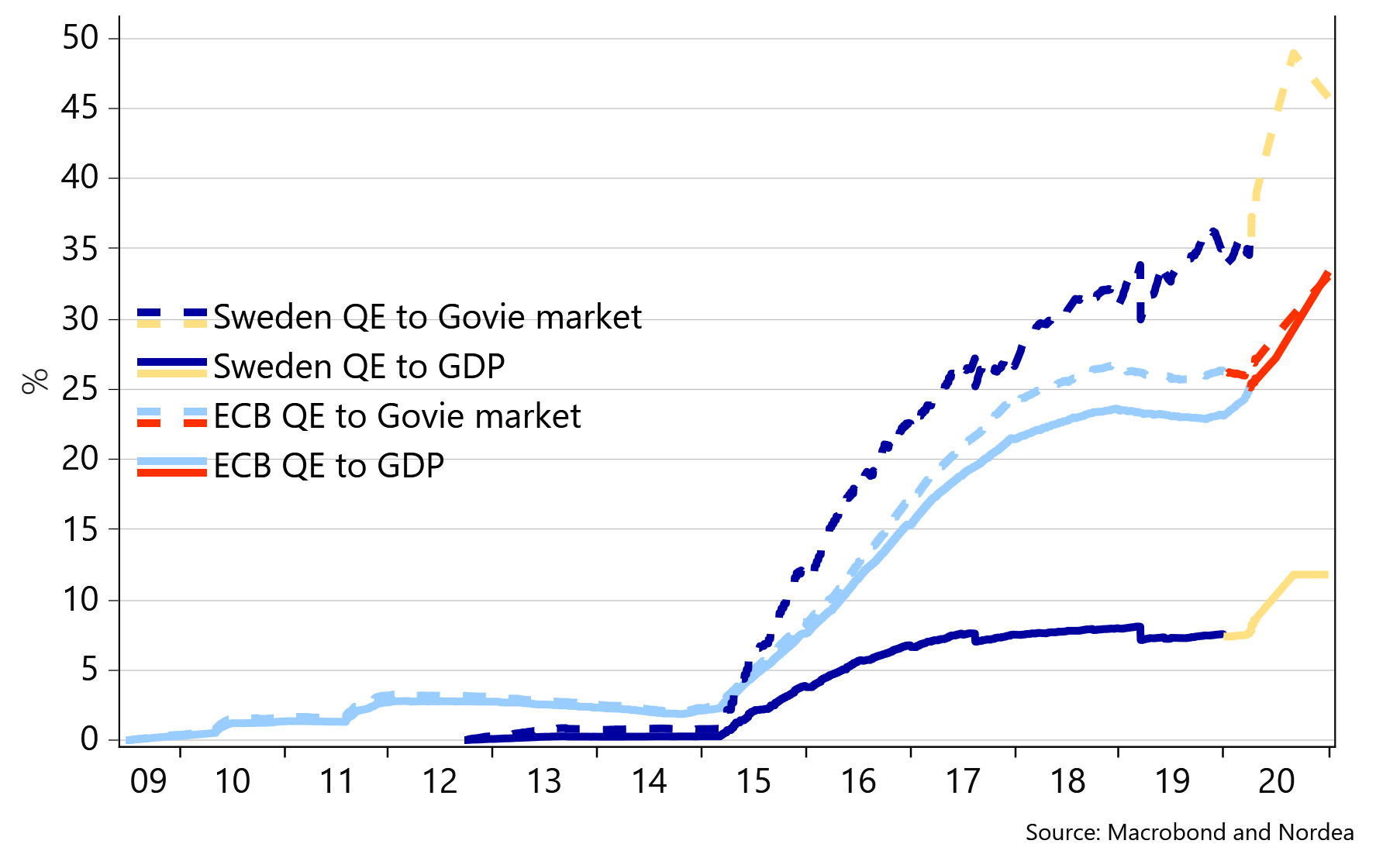

Snarkiness aside, we find the current Riksbank approach fairly sound. The Riksbank wants to support the credit cycle no matter what, but don’t see the need to return to NIRP unless absolutely necessary. And if spreads start to widen, we know by now that Ingves and co will be there to buy whatever it takes. Whether the current Riksbank QE regime is a restart of the Krona-killing-machine is a bit tricky to judge as the magnitude of Swedish QE is small compared to GDP relative to peers (5% in Sweden vs. almost 10% from the ECB). The Riksbank program is on the other hand very material in terms of QE size compared to the overall bond market due to the relatively small debt load of the Swedish government. We tend to think that the latter matters the most for FX since foreign holders of Swedish bonds will be squeezed out, but the jury is still out.

Chart 9: Whether the Riksbank QE size is material relative to peers depends on how you look at it

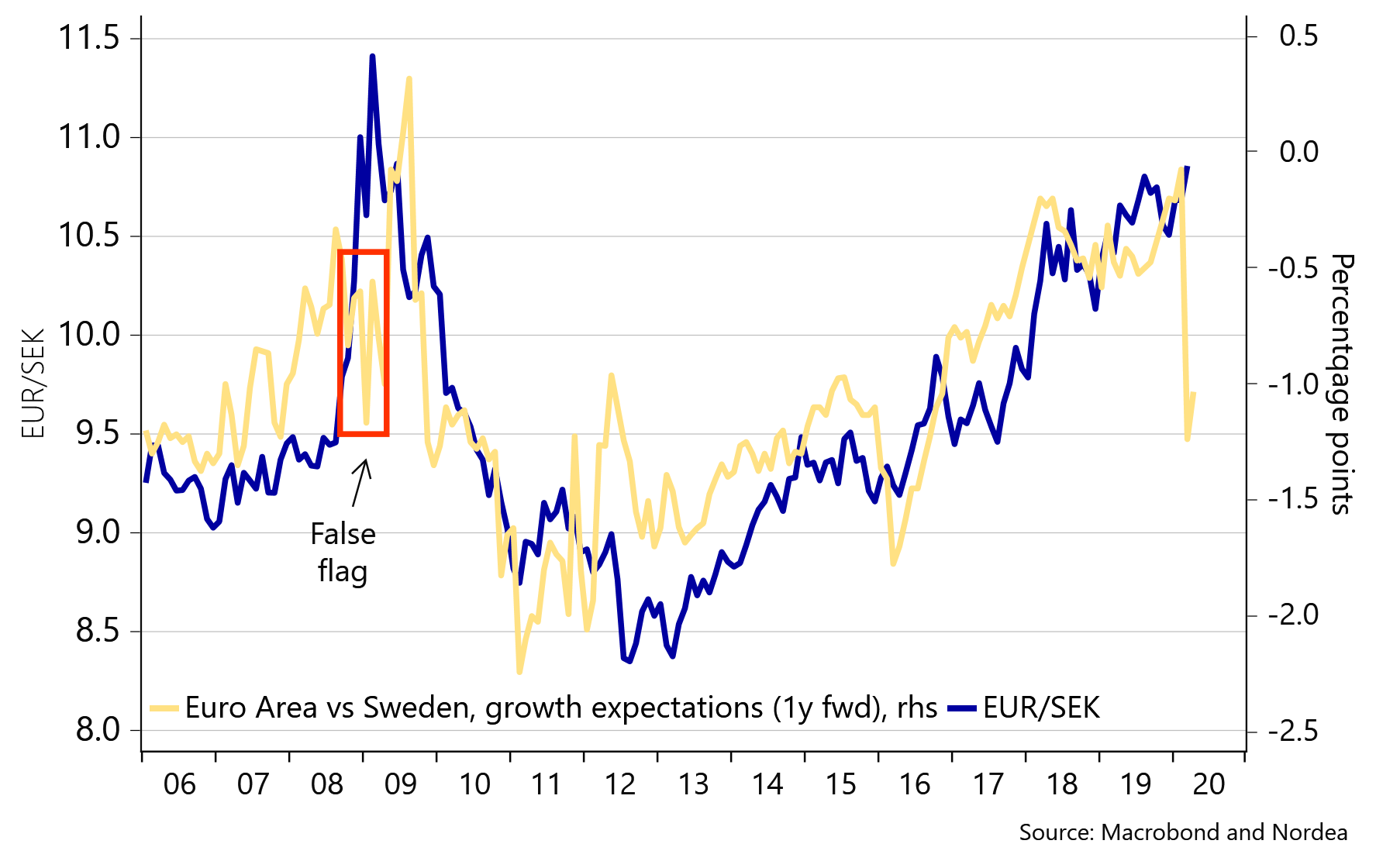

Either, Swedish economists are slow at DOOM-forecasting compared to Euro area colleagues, or else an incredibly positive SEK mood could be brewing. The 12month forward consensus on Swedish GDP is starting to look upbeat relative to the Euro area, which has earlier been a decent bellwether for SEK outperformance. We had similar potential false flags over the year-turn of 2008/2009 but it seems like the assessment of Swedish outperformance is more sound this time around.

With the less draconian Corona measures taken, it would be a surprise to see Sweden underperform versus the Euro area. So, when the dust settles, the Swedish corona strategy may prove to be a SEK positive driver in contrast to our initial fears (Yes, we occasionally admit to being wrong ��). For now, we decide to hold on to a buy on dips strategy in EUR/SEK (we were stopped out of longs after the Riksbank) in anticipation of a setback for risk in general and due to the substantial magnitude of Riksbank buying compared to the overall size of the Government bond market.

Chart 10: Consensus is starting to become very Sweden positive compared to the Euro area

Norges Bank has slashed rates and introduced extraordinary liquidity measures. We don’t think they will announce new measures at the monetary policy meeting on Thursday. The reason is simply that we think Norges Bank gets more and more uncomfortable the closer rates get to zero. As we approach zero, fiscal policy should take over the responsibility for keeping the wheels rolling. Down the road that could become a NOK positive driver. If you missed the FX weekly last week and wonder what fiscal policy has to do with the NOK you should read this piece.

The end of last week shows how vulnerable the NOK is to a souring in risk sentiment, so in the short run we prefer to stay sidelined. Oil prices have recovered quite a bit on better corona data and slower than feared increases in crude storages. And in reference to what looks to be lofty equities (at least) one could ask where the next NOK positive driver should come from in the short term.

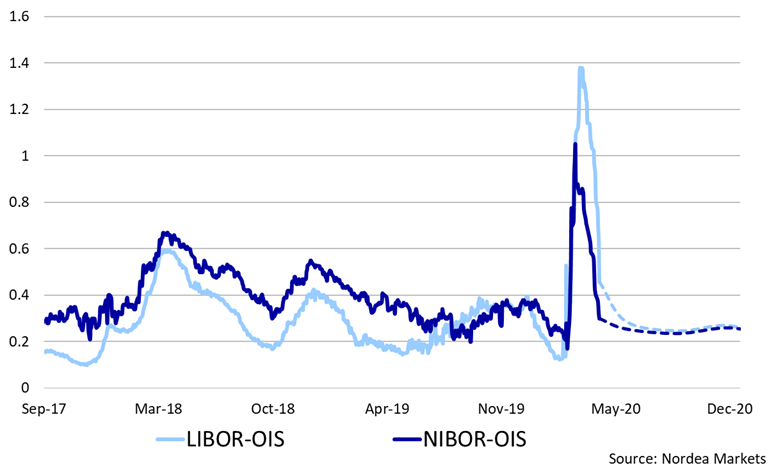

While “on hold” is the most likely outcome from Norges Bank on Thursday, we still like receiver positions in the short end of FRAs, in particular JUN ’20, currently at 0.445. The front end has admittedly collapsed already, but there is still good risk/reward in receivers. Frist of all, a rate cut should of course not be completely ruled out. Markets are probably pricing 5bp or so for a cut. Further, the Nibor/OIS is likely to compress further which will pull down Nibor and spill over to 3M JUN ’20 FRA.

Nibor/OIS has followed Libor/OIS lower and looking at that relation alone market pricing doesn’t look unfair. However, on top of the collapsing Libor/OIS comes huge liquidity measures from Norges Bank. Therefore, 3M Nibor could reach the low 0.30-levels soon.

Chart 11: Markets are not fully pricing the “Norges Bank liquidity” effect

Theme: Tourism is gone! Who’s worst off?

Borders could remain closed for most of 2020 as it has been evident from several “pilot-cases” that the imported virus spread is tricky to contain unless a draconian quarantine strategy is pursued (read; 2-3 weeks of quarantine when arriving at the border). This also leaves cross-border tourism almost stone-dead for much of the remainder of 2020.

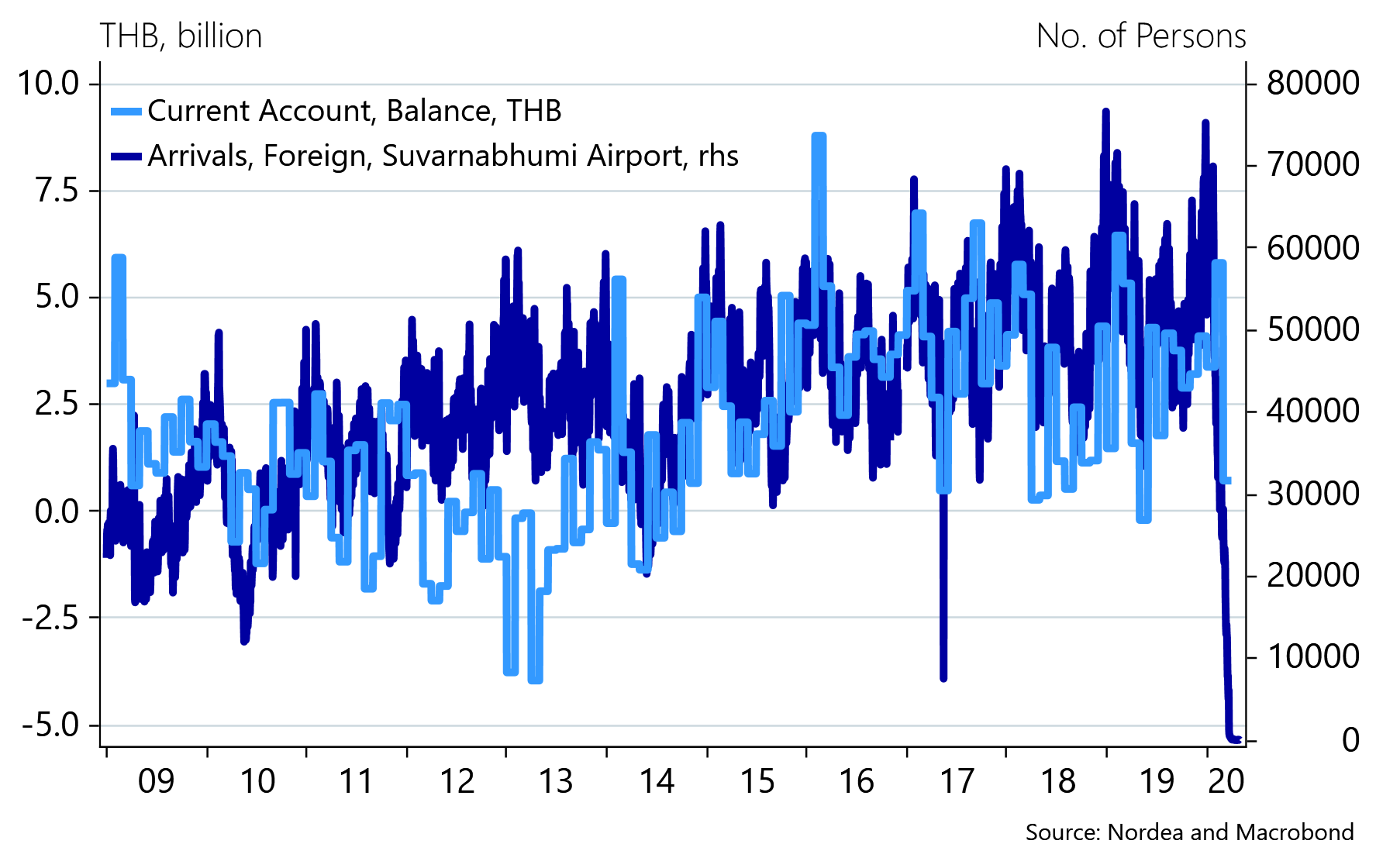

Thailand is one of the countries that will face an uphill battle due to the lack of tourism as more than 20% of GDP stems from it. The Suvarnabhumi airport usually sees >50,000 daily foreign arrivals, and currently we are at (almost) zero. This also means that the Thai Current Account balance may fold like a lawn chair, which is usually bad for the currency unless enough carry is in place to support it. We continue to like long USD/THB positions, consequently.

Chart 12: Without tourism the Thai Current Account Balance will fold like a lawn chair

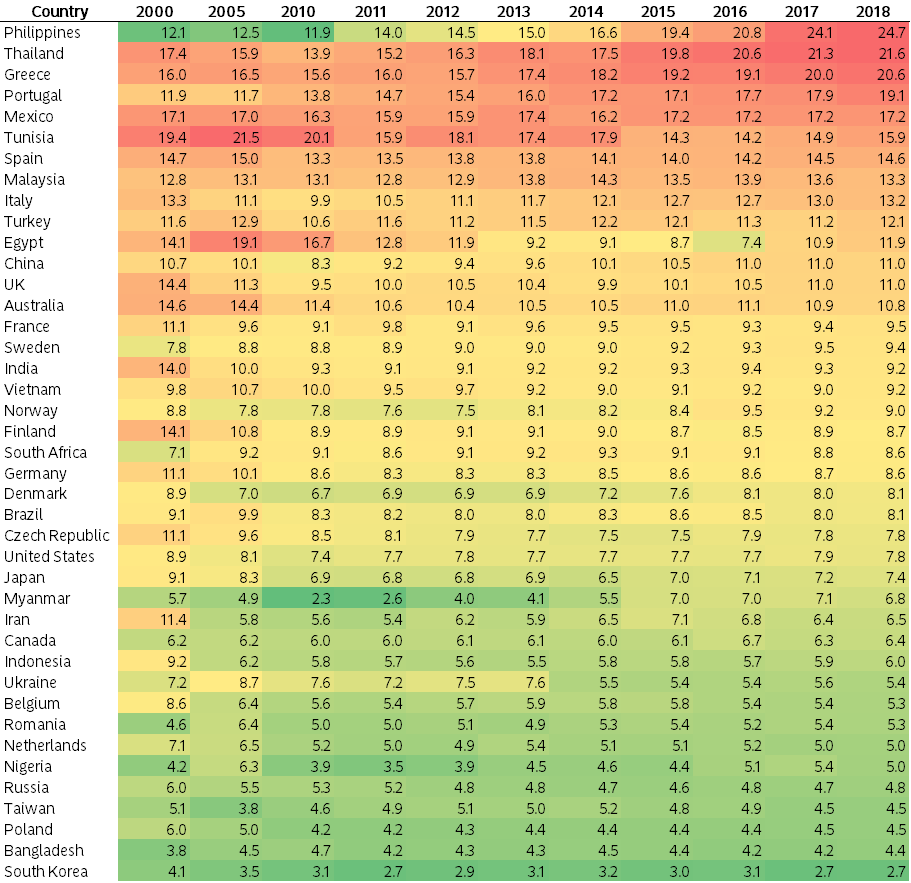

Below you will find a heat-map of Tourism as % of GDP in countries with more than 10 million inhabitants (Nordic countries are included). Note that Spain, Greece, Italy and Portugal are all heavily dependent on tourism as well. In Spain, the current exit-plan reveals, that tourism is one of the last sectors that will be allowed a return to normal. Most likely not during 2020, and maybe not even until summer-2021.

Table 2: Heatmap of Tourism as % of GDP

Commentaires