Libellés

Libellés

- Afrique du sud2

- Agences de notation2

- Agnès Buzyn2

- agricultural commodities1

- AIG4

- Alain Chouet1

- Alan Greenspan1

- Albert Edwards1

- Alimentation5

- Allemagne5

- AMF2

- Analyse contrarienne10

- Analyse macroéconomique3

- Analyse technique13

- Analystes1

- analysts1

- Andrew Maguire1

- Angela Merkel1

- Apple2

- Arabie Saoudite3

- Argent2

- Argentine2

- ARM1

- Arnaque1

- Arrestations1

- Arrogance2

- asia1

- Assouplissement Monétaire5

- Augmentation de Capital1

- Auplata5

- Aurelian Ressources1

- Avalement haussier1

- Avocet Mining1

- Bailout1

- Banana Republic1

- Bank of England1

- Bank Run1

- Banksters1

- Banqueroute1

- Banques50

- Banques Centrales34

- Barclays1

- Barrick Gold2

- Barry Ritholtz3

- Battle of France1

- BCE12

- Bear Market Rally1

- Bear Stearns7

- Bears8

- Ben Bernanke9

- Berkshire1

- Bijouterie1

- Bilan2

- Bill Ackman1

- Bill Bonner2

- Billion Dollar Gramm1

- Bitcoin6

- Black Swan5

- BNP Paribas3

- Bonds2

- Bonne Année1

- Boris Johnson1

- bourse4

- Boursorama1

- Braudel4

- Brésil1

- BRICs2

- Broke movie1

- btcusd1

- Bulle14

- Bulle Immobilière6

- Bulle Spéculative8

- Buttonwood1

- BX47

- CAC 4020

- Californie1

- Capitalisation1

- Capitalisation Boursière2

- Capitalisme6

- Carry Trade2

- Carte2

- Case-Shiller3

- Cash1

- CDS7

- Central Banks5

- CFD1

- CFTC1

- Changement climatique3

- Chen Lin1

- Chevalier Noir1

- China2

- Chine14

- Chomage3

- Chris Kimble1

- Christine Lagarde1

- Citation du jour1

- Classe d'actifs2

- Classement1

- Clive Maund1

- Cloroquine1

- CMBS1

- CNBC1

- commodities3

- Communication2

- Compagnie aérienne2

- Confession1

- Confinement6

- Conseil Financier1

- Consommateurs US1

- Conspiracy1

- Conspiration2

- Constructeurs automobiles2

- Continent africain1

- Contrarien2

- Conway1

- Corée du Sud1

- Coronakrach15

- Coronavirus49

- Correction1

- Correlation11

- Countrywide1

- Cours de l'or6

- Cours négatif1

- Courtier en ligne1

- COVID-1911

- CPI1

- Crash2

- Crédit2

- Credit crunch41

- Credit Suisse1

- Crise économique5

- Crise financière36

- Crise systémique30

- Croissance1

- Cryptocurrencies3

- Cul1

- currencies19

- Cycles1

- Cygne Noir3

- Daily Reckoning1

- Dave Portnoy1

- David Graeber1

- De Gaulle1

- Débat1

- Défaut4

- Deficit4

- déficit2

- Deflation11

- Déflation15

- Deleverage3

- Denial1

- Dépréciations1

- depression1

- Dérégulation1

- Dette américaine13

- dette souveraine16

- Dettes3

- dévaluation1

- development1

- Devises5

- Dexia1

- Didier (Soros35)1

- Dinde de Noel1

- Diplomatie1

- Disposable Income1

- Divergence1

- Dollar60

- Dollar index2

- Donald Trump3

- Dot.com krach1

- Dow Jones12

- Dow/Gold ratio4

- Dr Doom1

- dshort2

- Economics2

- Economie politique10

- Editorial8

- education1

- Effet de levier1

- Efficacité énergétique2

- Egypte2

- Elon Musk1

- Emmanuel Todd6

- Emploi US1

- Empreinte carbone2

- Emprunts Hypothécaires1

- endettement33

- Energie2

- Enfer1

- Epargne1

- Epidémie1

- EPS1

- Erin Burnett1

- Espagne2

- états2

- Etats souverains3

- Etats-Unis31

- ETF4

- Ethereum1

- etoro1

- Euro25

- Euro Ressources34

- Euro Ressources SA1

- Europe4

- Eva Illouz1

- Everything Bubble1

- Exubérance Irrationelle1

- Facebook2

- Faillites3

- Fannie Mae6

- farming1

- FED48

- Fernand Braudel1

- FESF4

- Fiat currencies1

- Fibonacci2

- Financial Armaggedon1

- Financial Sense1

- Fiscalité3

- Flash Krach1

- Flowchart1

- FMI3

- Fondamentaux2

- Fonds souverains1

- food prices1

- Foreclosuregate1

- Forex6

- Fortis1

- Fortune1

- France6

- France 402

- Franco-Nevada2

- Freddy Mac5

- Frédéric Lordon1

- Fresnillo1

- Friggit1

- Fukushima1

- Gael Giraud1

- GAFAM6

- Gamification1

- Gaz de Schiste1

- GDX5

- GDX/Gold ratio1

- GDX/SPY ratio1

- GDXJ2

- geopolitical risk9

- Geopolitics1

- Géopolitique21

- George Bush Junior1

- Georges Soros2

- Georgie1

- GIEC1

- Gilead1

- GM1

- Gold77

- Gold Bonds ratio1

- Gold Royalties14

- Gold Royaties2

- gold stocks4

- Gold/Oil ratio14

- Goldman Sachs4

- Gourous1

- Gouvernement5

- Graphique8

- Grèce9

- Greenspan1

- Grippe1

- Guerre3

- guerre commerciale2

- Guerre des monnaies1

- Guyane française1

- Haircut2

- Halloween1

- Harmony Gold1

- Health Care2

- Hedge Funds1

- hedging7

- Helicopter Money1

- Henry Ford1

- High Frequency Trading2

- Hin Leong1

- Histoire2

- Historique3

- Hitler1

- Hochschild Mining1

- Household net worth1

- Hugo Chavez1

- hui6

- Humour10

- hyperinflation3

- Iamgold11

- IBM1

- idées d'investissement4

- Idéologie1

- IEA1

- IMF1

- Immobilier51

- Inde2

- Index1

- Indices Actions17

- Indignés1

- Industrie1

- Indymac1

- Inégalités3

- Inflation63

- Inflation vs Deflation11

- Infographie2

- Information2

- Information Blog5

- Insolvabilité1

- Internet2

- Intox2

- Introduction1

- Investissement4

- Investment Banks3

- Iran11

- Iraq1

- Irina Werning1

- ISDA1

- Italie1

- Jacques Sapir1

- Jean-Claude Trichet2

- Jeffrey Epstein1

- Jerome Powell1

- Jesse's Americain Café1

- Jeus1

- Jim Chanos2

- Jim Cramer2

- Jim Rogers1

- Jobs à la con1

- John Dessauer1

- John Thain1

- Jon Stewart1

- Journaux1

- JP Morgan1

- Juan Branco1

- Julian Assange1

- Junior gold stocks18

- Kerviel3

- Kevin Warsh1

- Keyra Agustina1

- Kimble1

- Kinross1

- Kondratieff1

- Krach7

- Krach du pétrole1

- Lagourde1

- Lance Roberts1

- Le Monde1

- Le monde d'après1

- Le Monde Diplomatique1

- Lehman Brothers7

- Les Echos1

- Liberalisme1

- Life is a Journey1

- Liquidité2

- liquidity crisis3

- Logistique1

- Long Terme13

- Long/Short2

- Longue durée4

- Lutte des classes1

- M22

- Maastricht2

- Macro-Economie3

- Macron4

- Madoff1

- Maison Blanche1

- Mamadu1

- Manifestations1

- Manipulation4

- Map1

- Marc Fiorentino1

- Marc Roche1

- Marchés Actions56

- Marchés financiers2

- Mario Draghi3

- Mark Hulbert3

- Market Breadth1

- Market sentiment1

- Markowski1

- Masse monétaire4

- Matières Premières25

- Matt Taibbi1

- MBS1

- Media3

- Média1

- Megaphone2

- Memorial Day1

- Merkozy1

- Merrill Lynch4

- metals1

- Méthode de Trading4

- Michael Covel1

- Michael Moore1

- Microsoft1

- Mike Shedlock1

- Millenials1

- Minefinders1

- Mines11

- Mines d'or16

- mining1

- Moderna1

- monetary policy1

- Monetisation1

- monnaie3

- Monolines2

- Montages financiers1

- montagne1

- Monty Python1

- Moody's1

- Morgan Stanley1

- NASDAQ6

- Nassim Nicholas Taleb4

- Newmont Mining1

- Nicolas Sarkozy3

- Noam Chomsky1

- Nordea1

- Nucléaire4

- Obama3

- Obligations9

- Occupy Wall Street3

- Oil19

- Olivier Delamarche1

- Once d'or5

- OPA10

- OPEP2

- Opinion1

- Or101

- Pandémie1

- paper currency2

- Papier-monnaie2

- parapente1

- Paris2

- Paris Hilton1

- Patrimoine1

- Paul Krugman3

- Paul Tudor Jones1

- Paulson2

- Pauvreté1

- peak1

- Peak Oil2

- Pepe Escobar2

- PER4

- Performances2

- Peter Tchir2

- Petrole2

- Pétrole40

- Photographie1

- PIB2

- PIGS3

- PIIGS3

- Place Tahrir1

- Placements1

- Plan Paulson1

- Platinum1

- Point de vue5

- politics1

- Portefeuille virtuel2

- Positions3

- Positions Actuelles1

- Poutine1

- Powerpoint1

- Pr Didier Raoult1

- Prédictions5

- Présentation du Blog1

- Presse1

- prévisions1

- Printing money1

- Private Equity1

- Production d'or1

- Propagande3

- Protection1

- Psychologie3

- Psychologie des marchés5

- Puerta del Sol1

- Pump & Dump1

- Q ratio1

- Qassem Soleimani1

- QE2

- QE Eternity3

- QE23

- QQQ1

- Quantitative Easing10

- Randgold Ressources1

- Ratio dette/PIB2

- ratio Market Cap/US GDP1

- Ratio Or/Pétrole1

- Ratios2

- real estate1

- Recession1

- Récession9

- records1

- Réflexion1

- Reggie Middleton3

- Régulation1

- Religion1

- Républicains1

- République bananière1

- Retour à la normale2

- Revenus2

- Révolution1

- Ripple1

- Risk off3

- Risque2

- Rob McEwen1

- Robinhood1

- Robo Signers1

- Rosenberg1

- Roubini2

- Royal Gold2

- Royal Gold Inc1

- Royaume-Uni2

- Russie3

- S&P50013

- S&P500/Gold ratio4

- Saisonnalité7

- Sartoni1

- Sauvetage des banques1

- Scandale2

- Scandinavie1

- scénario1

- Science2

- SEC2

- Securitization13

- Sentiment4

- September 111

- Shanghai1

- silver2

- Silver Standard Reserve1

- ski1

- Slideshare1

- Small Cap2

- Société1

- Société Générale8

- Sociopathie3

- Soitec1

- Source d'informations1

- Spanish Revolution2

- Spéculation5

- Speedflying1

- SPX6

- SPY1

- SSEC1

- St1

- stagflation9

- Standard and Poors 5004

- Star Wars1

- Statistiques3

- STINC1

- stock market1

- Stock market2

- Stratégie1

- strategy1

- Subprime19

- Suisse1

- Suivi de tendance2

- Surmortalité1

- Sven Henrich2

- Swiss National Bank1

- Syrie1

- Système Bancaire1

- Système de santé3

- Taux d'intérêts4

- TBT2

- Technologie3

- technology1

- Teletravail1

- Terrorism4

- TESLA3

- Teslacharts1

- Thailande1

- The Economist17

- Thomas Jefferson1

- timing1

- Titrisation13

- Todd Harrison1

- Trading3

- Trading Algorithmique1

- Treasuries3

- Trend Following2

- Trump2

- Twitter1

- UBS1

- UDN1

- Union Européenne4

- Uranium1

- USD1

- Vacances1

- Vaccin1

- Valorisation1

- Value at risk5

- Vente à découvert2

- Ventes d'or1

- Vietnam1

- VIX3

- Voeux1

- Volatility7

- vote1

- Walk Away1

- Wall of worries1

- Wall Street11

- Wallerstein1

- Warren Buffett4

- Washington Mutual1

- Weinstein1

- Williambanzai2

- Wilshire 50001

- wordle1

- XAU1

- Yamana Gold1

- Yen4

- Yuan1

- Zeal LLC2

- Zero Hour1

- Zimbabwe2

Rechercher dans ce blog

Une Macro-Perspective (parfois polémique) sur les marchés financiers et l'économie politique...

Articles

Affichage des articles du novembre, 2011

Publié par

Alex Kerala

Le meilleur indicateur de tendance ?

- Obtenir le lien

- X

- Autres applications

Publié par

Alex Kerala

A propos du "Deleveraging " : Une étude intitulée Payback Time

- Obtenir le lien

- X

- Autres applications

Publié par

Alex Kerala

Goldman Sachs, le trait d'union entre Mario Draghi, Mario Monti et Lucas Papadémos

- Obtenir le lien

- X

- Autres applications

Publié par

Alex Kerala

Une nouvelle réflexion concernant la corrélation entre EUR/USD et les indices actions, et ce qui peut l'expliquer.

- Obtenir le lien

- X

- Autres applications

Publié par

Alex Kerala

Au sujet du non déclenchement des CDS sur la dette grecque

- Obtenir le lien

- X

- Autres applications

Publié par

Alex Kerala

L'Or au dessus de 1300 Euros. Contagion dans l'eurozone ?

- Obtenir le lien

- X

- Autres applications

Publié par

Alex Kerala

La diplomatie en Europe

- Obtenir le lien

- X

- Autres applications

Publié par

Alex Kerala

Comment les Banques Centrales ont pris le contrôle des marchés de capitaux.

- Obtenir le lien

- X

- Autres applications

Publié par

Alex Kerala

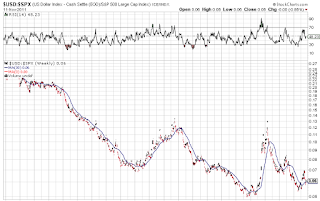

Analyse Technique Wilshire 5000

- Obtenir le lien

- X

- Autres applications